Analyzing QCOM Stock: Recent Trends and Future Outlook

Introduction

Toronto, ON – Qualcomm, Inc. (QCOM) has remained a key player in the semiconductor industry, especially in the mobile technology sector. With the expansion of 5G technology and increasing demand for Internet of Things (IoT) devices, tracking the performance and potential of QCOM stock is essential for investors seeking opportunities in this rapidly changing market.

Recent Performance of QCOM Stock

As of late October 2023, QCOM stock is experiencing a notable uptrend following a series of strategic partnerships and product releases that emphasize its leadership in 5G technology and wireless communications. In the last quarter, Qualcomm reported revenue growth of 21% year-over-year, driven by strong sales of premium chipsets and licensing revenues from its extensive patent portfolio.

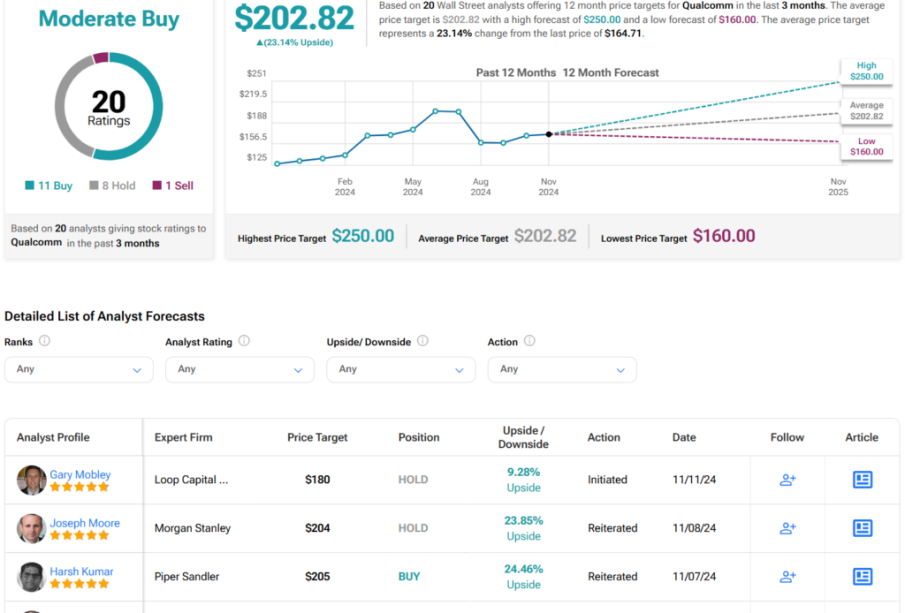

Furthermore, Qualcomm’s stock has shown resilience amidst broader market fluctuations, attributed to its solid earnings reports and a bullish outlook on 5G adoption globally. According to analysts at major financial institutions, the stock price is projected to rise further, suggesting a target price of $180 per share within the next 12 months.

Strategic Developments and Industry Challenges

Qualcomm’s success can also be linked to its venture into automotive applications and the expansion of IoT solutions. The company recently announced collaborations with major automotive manufacturers to enhance the connectivity and intelligence of vehicles, a move that is anticipated to create new revenue streams.

Despite the positive outlook, Qualcomm faces challenges, including supply chain disruptions and increased competition from rivals in the semiconductor space, such as Nvidia and AMD. Additionally, geopolitical tensions and trade regulations could impact its international operations and market access.

Conclusion

In summary, QCOM stock presents a compelling case for investors due to its strong performance metrics and strategic positioning within the 5G and semiconductor markets. Analysts remain optimistic about its growth trajectory, particularly with innovations in technology and expansion into new sectors. However, potential investors should stay informed about market conditions and competitive dynamics that may affect Qualcomm’s future performance. As always, thorough research and a well-planned investment strategy are recommended for anyone considering an entry into QCOM stock.