Analyzing PDD Stock: Recent Developments and Future Outlook

Introduction to PDD Stock

PDD Holdings Inc. (NASDAQ: PDD), the parent company of the popular Chinese e-commerce platform Pinduoduo, has been gaining attention among investors due to its unique business model and rapid growth in the e-commerce sector. Understanding the current trends and events surrounding PDD stock is crucial for both current shareholders and potential investors, as the market continues to evolve post-pandemic.

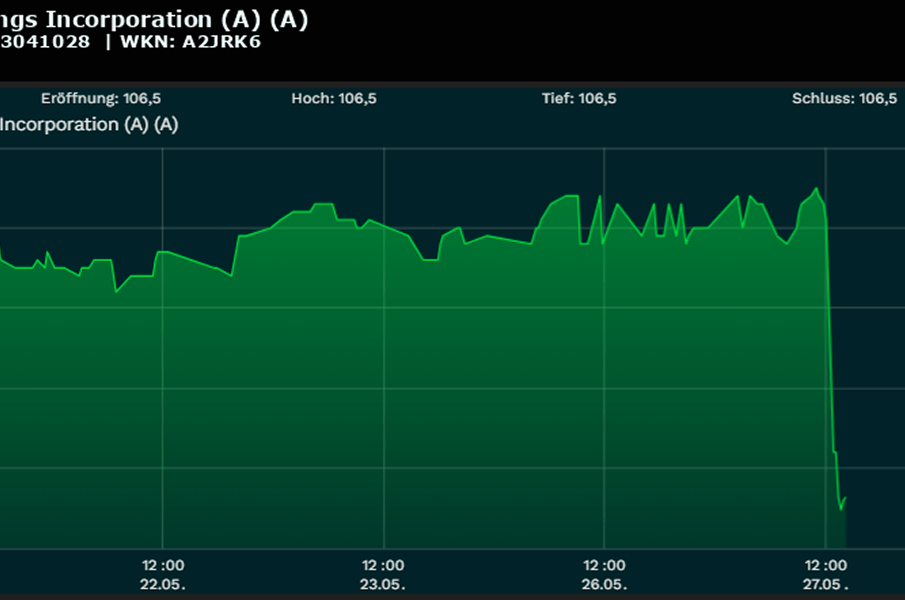

Recent Market Performance

As of October 2023, PDD stock has experienced notable fluctuations, reflecting wider trends in the tech and e-commerce markets. The stock price recently surged following the company’s impressive earnings report for Q3 2023, which showed a 45% increase in year-on-year revenue, attributed largely to its expanding user base and enhanced marketing strategies. Analysts have highlighted that Pinduoduo’s focus on direct-to-consumer sales and innovative social shopping features have resonated well within the growing Chinese e-commerce landscape.

Key Developments in the Company

One of the key factors driving PDD’s stock performance is its investment in technology and logistics, which has helped improve customer experience and operational efficiency. The company has been integrating AI and machine learning to optimize its supply chain, providing recommendations tailored to shopper preferences. Additionally, PDD has been expanding its reach beyond China by exploring international markets, aiming to replicate its successful model globally.

Analyst Outlook and Future Forecasts

Market analysts remain optimistic about PDD’s potential, with several firms adjusting their price targets upward following the recent earnings report. The average price target suggests that PDD stock has room for growth, as investors recognize the company’s potential to compete against giants like Alibaba and JD.com. Risks, however, remain, such as regulatory hurdles in China and potential economic slowdowns that could impact consumer spending.

Conclusion

In summary, PDD stock presents a compelling case for investors who are looking to tap into the thriving e-commerce sector in China and beyond. With its innovative approach and solid financial performance, Pinduoduo is well-positioned to continue its upward trajectory. As always, potential investors should remain cautious and conduct thorough research, as market conditions can change rapidly, impacting the stock’s performance in the near term.