Analyzing PayPal Stock: Trends, Performance, and Expectations

Introduction

PayPal Holdings Inc. has been a staple in the digital payment industry since its inception. Its stock performance serves as a crucial indicator for investors and analysts alike, reflecting broader trends in fintech and e-commerce. As digital payment solutions continue to rise in demand, understanding the dynamics of PayPal’s stock is increasingly important for both seasoned and novice investors.

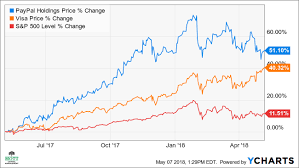

Recent Performance

As of the latest trading data in October 2023, PayPal stock (NASDAQ: PYPL) has seen fluctuations in response to various market factors. Throughout the year, significant volatility influenced by inflation concerns, interest rates, and consumer spending has led to variations in stock prices. In late September, PayPal’s shares were trading around $65, with analysts projecting a potential upswing as investors regain confidence in the fintech sector.

Strategic Developments

Recent strategic initiatives by PayPal have also impacted its stock performance. The company has made headlines by expanding its services beyond payments, tapping into cryptocurrency, and establishing partnerships with e-commerce platforms. Additionally, PayPal’s efforts to enhance cybersecurity and improve user experience have been vital in maintaining customer trust and retention. These developments hint at a possible upward trend as the market recognizes PayPal’s adaptability in a rapidly evolving digital landscape.

Analyst Predictions

Market analysts have mixed sentiments on the future of PayPal stock. Some predict a bullish outlook, citing growth in digital transactions and the company’s robust customer base as contributing factors. Others warn of potential risks, including increased competition in the payment space from rivals like Square and various neobanks. According to a recent report by investment firm Goldman Sachs, PayPal’s stock could see a price projection of up to $80 in the next 12 months, given favorable market conditions and continued innovation.

Conclusion

In conclusion, PayPal stock represents a blend of opportunity and risk amidst a changing financial landscape. As the company continues to adapt and innovate, investors will need to closely monitor market trends and internal developments. For those looking to invest, understanding both the current performance and future potential of PayPal stock is essential for making informed decisions. With digital payment solutions showing no signs of slowing down, PayPal remains a key player in the space, and its stock will likely remain a focal point for investors well into the future.