Analyzing Oklo Stock: Performance and Market Potential

Introduction to Oklo Stock

In recent years, investment in renewable energy has surged, with many investors looking towards companies that aim to revolutionize the energy sector. One such company is Oklo, a startup focused on advanced nuclear technology. With its commitment to sustainable energy solutions, Oklo stock has garnered significant interest from investors, analysts, and environmental advocates alike.

Recent Developments

Oklo, which specializes in compact nuclear reactors, has made headlines for its innovative approach to clean energy. In FY 2023, the company secured a major contract with the U.S. Department of Energy to develop its first plant, which is intended to provide clean power by 2025. This favorable government support has boosted investor confidence and has led to a strong uptick in Oklo’s stock price, which has increased by approximately 45% since January.

Despite the challenges associated with the nuclear energy sector, such as public perception and regulatory hurdles, Oklo’s unique technology has positioned it favorably in the market. Its compact reactors promise to deliver highly efficient and safe nuclear energy, which could provide a viable alternative to traditional fossil fuels.

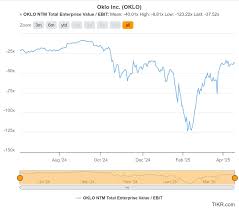

Current Stock Performance

As of October 2023, Oklo stock is trading at $25 per share, reflecting a healthy market capitalization of over $1 billion. Analysts have noted that the stock has a strong ‘buy’ rating, driven by increasing demand for sustainable energy solutions and the company’s robust growth projections. The price-to-earnings ratio remains attractive when compared to other companies in the renewable energy sector.

Future Projections

Looking ahead, several analysts forecast continued growth for Oklo stock, with estimates suggesting a potential rise to $35 per share by mid-2024, contingent on the successful launch of its first operational reactor and further government backing. As many countries strive to meet their carbon-neutral goals, companies like Oklo may play a pivotal role in transitioning to clean energy sources.

Conclusion

Oklo stock presents an intriguing investment opportunity in the rapidly evolving landscape of renewable energy. With the combination of a strong product offering and supportive regulatory frameworks, investors may find Oklo to be a valuable addition to their portfolios. As the world increasingly moves towards sustainable energy solutions, watching the trajectory of Oklo stock will be crucial for stakeholders in the energy market.