Analyzing Google Stock: Current Trends and Future Outlook

Introduction

The performance of Google stock, trading under the parent company Alphabet Inc., is a critical indicator of the technology sector’s health. Given Alphabet’s significant market capitalization and influence, investor interest in GOOG stock generates discussions surrounding its growth prospects, earnings reports, and market dynamics. As many analysts predict mixed results with changing economic conditions, understanding Google stock’s recent performance is essential for investors.

Current Performance

As of October 2023, Google stock is trading around $140 per share, showcasing a modest increase of approximately 10% year-to-date. This stability comes even as the broader tech sector faces volatility due to rising interest rates and inflation concerns. Recently, Google’s third-quarter earnings report highlighted a 6% increase in revenue year-over-year, even amidst challenges like competition from Microsoft in cloud computing and ongoing regulatory pressures in various countries.

Key Events Impacting Google Stock

Several factors have influenced Google stock’s recent trajectory. The launch of Google’s AI features across its product suite has renewed investor optimism about the company’s growth prospects. Furthermore, according to a recent CNBC report, Alphabet’s continued investments in artificial intelligence and machine learning have set a strong foundation for future revenue streams, positioning the company as a leader in innovation.

However, challenges still loom. The European Union’s regulatory scrutiny over data privacy and the recent lawsuit regarding anti-competitive practices remind investors that growth may come at a cost. Analysts predict that such factors might affect stock valuation and overall market perception in the near term.

Future Outlook

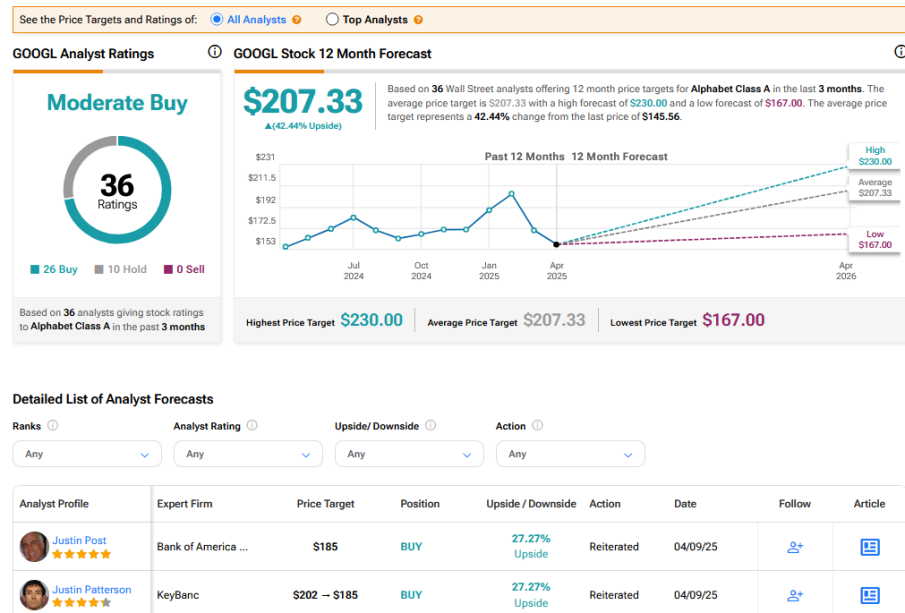

The outlook for Google stock remains cautiously optimistic. Analysts’ forecasts suggest that if Alphabet continues to innovate and expand its market reach with emerging technologies, the stock could see a price increase over the next year. With EPS (Earnings Per Share) growth projected at 15% for the upcoming quarters, along with potential operational efficiency improvements, Google stock remains an attractive option for long-term investors.

Conclusion

In conclusion, Google stock’s current performance demonstrates resilience amid economic uncertainties. The combination of strong earnings, a commitment to innovation, and strategic positioning within emerging markets creates a favorable environment for future growth. Yet, investors must remain vigilant of regulatory risks and market dynamics. Overall, for those looking at investing in technology stocks, Google offers a compelling proposition with its robust business model and forward-looking initiatives.