Analyzing Dollarama Stock Performance in 2023

Introduction

Dollarama Inc., a major player in Canada’s retail landscape, is a company that has garnered significant attention from investors. Known for its value-driven offerings, Dollarama operates a chain of dollar stores across the country. As many Canadians look for affordable shopping options, the company remains relevant amid economic uncertainties. The stock’s performance has implications not just for investors, but also for consumers and the retail market as a whole.

Current Market Performance

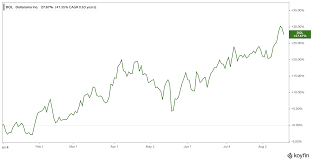

As of October 2023, Dollarama’s stock (DOL) has shown resilience, trading around $88.50 CAD per share. The stock has experienced volatility, reflective of broader market trends and consumer behavior shifts post-pandemic. Despite these fluctuations, analysts express a generally optimistic outlook, citing strong sales performance driven by a booming demand for low-cost goods and effective supply chain management.

The company’s latest financial results indicated an increase in revenue of 10% year-over-year, demonstrating the effectiveness of Dollarama’s business model. The rise in consumer prices has led more shoppers to seek cost-saving alternatives, further boosting Dollarama’s appeal. Recently released earnings also confirmed that the company plans to expand its footprint, with plans to open 60 new locations in the fiscal year, which could positively impact long-term growth.

Market Trends and Economic Factors

The ongoing inflation has shifted consumer behavior towards discount retailers, favoring chains like Dollarama that provide budget-friendly options. This trend is particularly crucial as many families are navigating financial constraints. Analysts suggest that as inflation continues to impact the economy, Dollarama is likely to benefit from the growing preference for value-oriented shopping.

Furthermore, the company’s strategic move to enhance its product variety—from household goods to food items—has expanded its market share. In recent months, they have increased their private label offerings, which not only cater to consumer preferences but also positively impact profit margins.

Conclusion

As Dollarama approaches the end of 2023, its stock appears to present opportunities for both current and prospective investors. The company’s balance sheet remains solid, supported by growth initiatives and an adaptable business model. As Canada’s economic environment evolves, Dollarama’s continued focus on providing value may further solidify its position as a market leader.

In summary, those interested in Dollarama stock should keep a close eye on industry trends, consumer behavior shifts, and company announcements that could signal the stock’s future performance. With the potential for continued growth, Dollarama remains a significant topic in the retail investment landscape.