Analysis and Update on AVGO Stock: October 2023

Introduction

AVGO stock, the publicly traded shares of Broadcom Inc., is a crucial element in the semiconductor industry, especially as the demand for technology continues to rise. The importance of following AVGO stock performance lies in its reflection of broader tech market trends and investor sentiment toward semiconductor companies. As industries increasingly rely on cloud computing, 5G, and artificial intelligence, Broadcom stands at the forefront of innovation, making its stock significant not only to investors but to the economic landscape as a whole.

Current Market Performance

As of October 2023, AVGO stock has shown robust performance, trading at approximately $880 per share, with an increase of around 15% year-to-date. This rise can be attributed to strong quarterly earnings that exceeded analyst expectations, showcasing a revenue growth of 10% year-over-year, driven by heightened demand in the semiconductor sector. Analysts are optimistic, projecting continued growth as sectors like automotive, data centers, and broadband expand their semiconductor requirements, signaling promising earnings for Broadcom in future quarters.

Recent Developments

Recently, Broadcom announced a major acquisition of a software company, which they believe will enhance their service offerings in the cloud computing space. This strategic move is aimed at increasing their competitive edge against rivals like Intel and NVIDIA. The market has responded positively to this news, reflecting confidence in Broadcom’s direction and management’s ability to diversify their revenue streams. Furthermore, a partnership with a leading telecommunications firm to enhance 5G capabilities has also been highlighted, further cementing Broadcom’s position as a key player in next-generation network infrastructure.

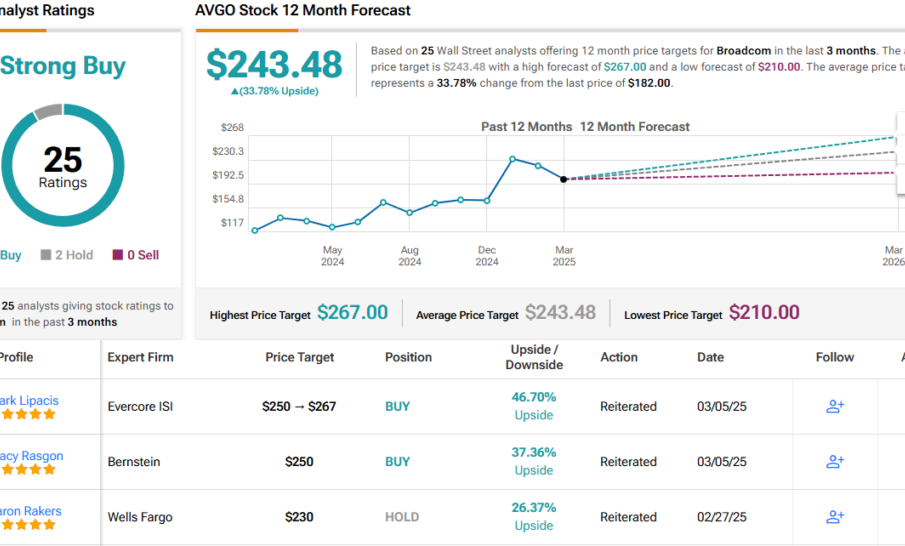

Investor Sentiment and Outlook

Investor sentiment surrounding AVGO stock remains strong, with many analysts issuing buy ratings based on Broadcom’s strategic initiatives and strong financials. However, challenges such as potential supply chain issues and geopolitical tensions could impact future performance. Investors are advised to monitor these factors closely, as they could create volatility in the stock price.

Conclusion

In summary, AVGO stock represents a vital and potentially lucrative opportunity for investors in the technology sector as it continues to adapt to the rapidly changing landscape of the semiconductor market. While the performance has been promising, investors should remain aware of external factors that could affect future growth. As technology continues to evolve, keeping an eye on Broadcom’s strategic moves will be pivotal for understanding AVGO stock’s trajectory in the coming months.