An Overview of Hims Stock Performance in 2023

Introduction

Hims Inc., a telehealth company that provides health and wellness products, has garnered significant attention since its IPO in January 2021. With the increasing demand for health services online, the performance of Hims stock not only impacts investors but also offers insights into the broader telehealth market. Understanding the movements of Hims stock is crucial for those following healthcare trends and investment opportunities.

Recent Performance and Market Trends

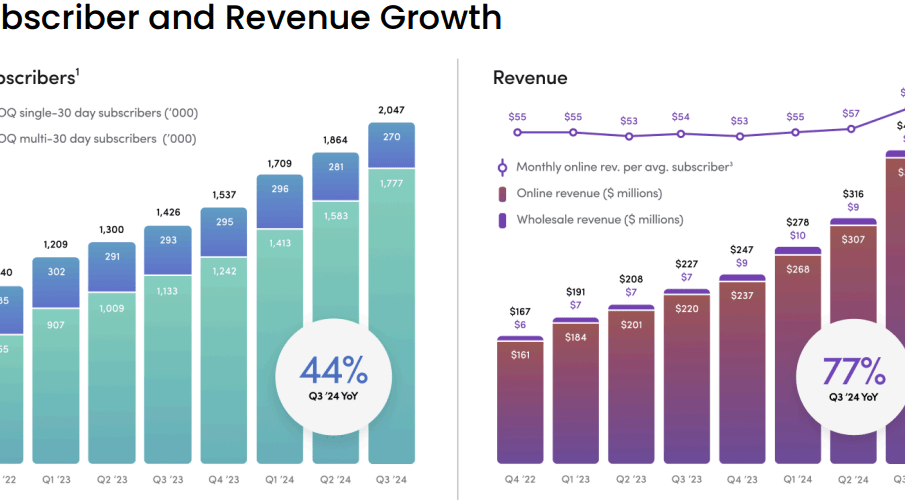

As of October 2023, Hims stock has seen substantial fluctuations, primarily influenced by market conditions and company performance metrics. After a notable decline in share price in late 2022, analysts have observed a gradual recovery throughout 2023. The stock has rebounded from its lows as the company reported a 35% increase in revenue in the second quarter, attributed to an expanding customer base and increased service offerings.

Investors keen on telehealth are paying close attention to Hims’ strategic initiatives. In recent months, the company has diversified its offerings, introducing new products aimed at wellness and preventive health. This diversification is a response to growing market competition and reflects a broader industry trend towards integrated healthcare solutions.

Analyst Opinions

Financial analysts remain divided on Hims stock’s future trajectory. Some bullish analysts forecast continued growth, citing the shift towards digital health solutions accelerated by the COVID-19 pandemic. They argue that Hims is well-positioned to capture significant market share, especially among millennials and Gen Z consumers who favor convenient, online access to healthcare.

Conversely, some analysts express caution, emphasizing potential regulatory challenges and increased competition from both established pharmaceutical companies and new entrants into the telehealth space. Market volatility and economic factors, including inflation and interest rates, also pose risks that stock investors should consider.

Conclusion

The performance of Hims stock remains an important topic for investors and stakeholders in the telehealth industry. With a robust recovery and innovative product offerings, Hims shows promise as a key player in an evolving market. As trends in telehealth continue to shape consumer behavior and investor interest, monitoring Hims stock will be essential. Investors should remain informed about both the opportunities and challenges ahead as the company navigates the evolving landscape of healthcare services.