An Overview of Hims Stock and Recent Performance Trends

Introduction

The stock market plays a vital role in the economy, serving as a barometer for corporate health and investor sentiments. In recent years, companies in the health and wellness sector have attracted significant interest, with Hims & Hers Health, Inc. (HIMS) standing out due to its innovative approach to telehealth services. Understanding the current performance of Hims stock is crucial for investors looking to gauge its potential in a rapidly evolving industry.

Current Stock Performance

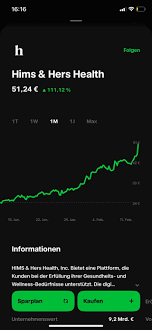

As of mid-October 2023, the market has seen fluctuations in Hims stock, reflecting broader trends in the healthcare sector and the economic landscape. Hims has focused on expanding its product offerings, which include prescription medications and over-the-counter health products aimed at common concerns such as hair loss, sexual health, and skin care. Through innovative marketing and robust online platform management, Hims has carved a niche for itself among younger demographics seeking accessible health solutions.

In its most recent earnings report, Hims reported revenue that exceeded analyst expectations, indicating strong customer acquisition efforts and renewal rates. The company noted a year-over-year revenue increase of 20%, which has bolstered investor confidence despite concerns regarding regulatory challenges in telehealth services across different states.

Market Trends and Future Projections

The telehealth market is expected to grow substantially, driven by increased consumer acceptance following the pandemic. Analysts predict that Hims will continue to benefit from this trend, projecting a favorable outlook for Hims stock in the medium to long term. The burgeoning demand for remote consultations and medication delivery can significantly impact Hims’ growth trajectory.

Furthermore, Hims is strategizing to enhance its service offerings by introducing new products and features within its app to improve user engagement and customer retention. Such developments are likely to resonate well with its existing subscriber base and attract new customers.

Conclusion

In summary, Hims stock has shown resilience amidst market fluctuations and is poised for potential growth as the telehealth sector expands. For investors, staying abreast of Hims’ evolving business strategies and overall market conditions is essential for making informed decisions. As health and wellness remain a priority for consumers globally, Hims’ innovative approach positions it well for future success, making its stock a topic worth watching closely.