An Insight into Boeing Stock: Current Market Trends and Analysis

Introduction: The Importance of Boeing Stock

Boeing, one of the largest aerospace manufacturers in the world, plays a crucial role in both commercial and defense aviation industries. The company’s stock is an essential focus for investors as it reflects trends in global travel demand, military spending, and technological advancements. Recent developments have made Boeing stock a hot topic among investors, analysts, and market observers.

Current Market Performance

As of late October 2023, Boeing stock has experienced notable fluctuations, primarily due to concerns related to supply chain issues and production timelines. The company reported its third-quarter earnings last week, surpassing analysts’ expectations with revenues of $16.2 billion and a net income surge compared to the previous year. However, concerns over delays in aircraft deliveries and ongoing supply chain disruptions have led to a cautious outlook among market analysts.

Over the past month, Boeing shares have seen a rise of approximately 10%, attributed to positive developments in its defense sector and a gradual recovery in global air travel. This increase positions Boeing stock as a more attractive option for investors looking for recovery plays amid economic uncertainty. Experts believe that with travel demand returning as pandemic restrictions ease, Boeing’s commercial aircraft segment could rebound strongly.

Future Outlook and Analyst Predictions

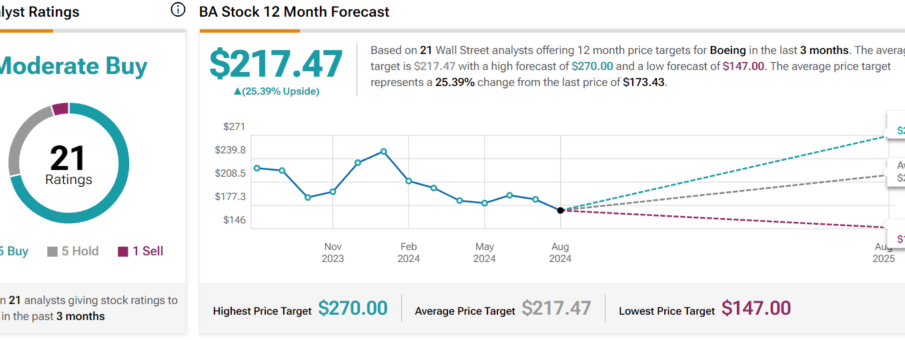

Looking ahead, analysts remain divided on Boeing’s stock trajectory. Some experts project significant growth driven by an increase in airline orders and military contracts, while others urge caution, pointing to the potential risk of further supply delays and geopolitical tensions affecting defense spending.

Goldman Sachs recently raised its price target for Boeing stock to $260, citing strong fundamentals in the aerospace sector. Conversely, analysts at UBS maintained a more bearish stance, predicting turbulence as the company navigates through its backlog of aircraft deliveries and rising costs related to parts and materials.

Conclusion: Significance for Investors

For investors, Boeing stock presents a compelling opportunity mixed with risks that must be carefully evaluated. The stock’s performance is closely tied to broader economic conditions, regulatory changes, and competitive dynamics within the aerospace industry. Understanding the nuances of Boeing’s market position is vital for making informed investment decisions.

As global air travel recovers and military expenditures rise, Boeing’s long-term prospects seem optimistic. Nevertheless, potential investors should keep a wary eye on quarterly earnings reports and operational updates that may hint at future challenges to be navigated. As such, a careful analysis of market trends will be essential for maximizing returns on Boeing stock investments.