An In-Depth Look at VOO Stock and Its Investment Potential

Introduction to VOO Stock

VOO stock, the ticker symbol for Vanguard S&P 500 ETF, has become increasingly popular among investors seeking exposure to the U.S. equity market. Launched in 2010, VOO offers a cost-effective way for investors to access the performance of the S&P 500 index, which consists of 500 of the largest publicly traded companies in the United States. Its significance not only lies in its low expense ratio but also in its historical performance of relatively high returns.

Current Performance Highlights

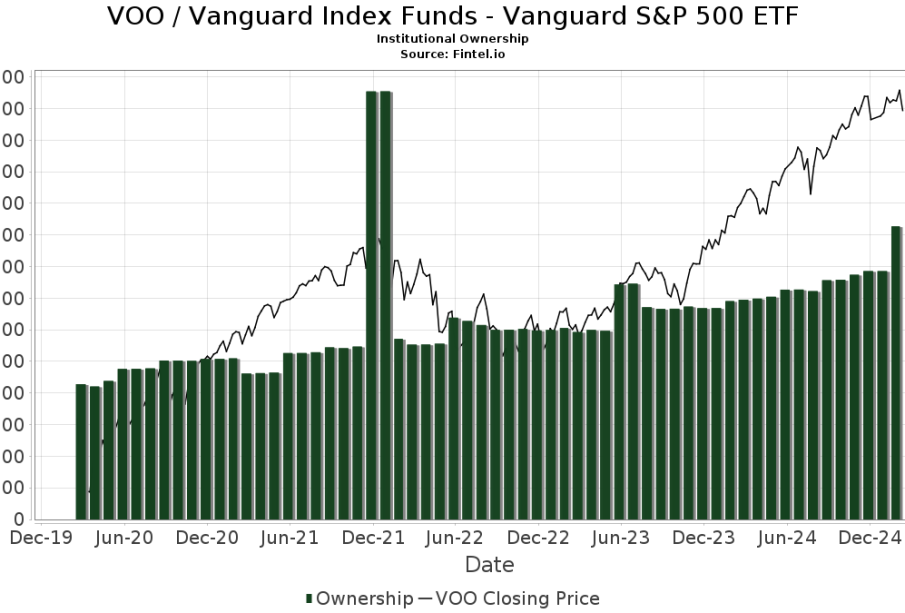

As of October 2023, VOO stock has been experiencing an upward trend, mirroring the robust performance of the S&P 500. The ETF has returned approximately 15% year-to-date, reflecting the recovery of key sectors such as technology and healthcare. With the backdrop of economic recovery post-pandemic, many market analysts are optimistic about the continued potential for growth in Q4 2023.

Key Factors Influencing VOO Stock

A variety of economic indicators influence the performance of VOO stock, including interest rates, inflation rates, and corporate earnings reports. The Federal Reserve’s monetary policy decisions play a significant role, as changes in interest rates can impact the performance of growth stocks within the index. Furthermore, strong earnings reports from major companies like Apple, Microsoft, and Amazon have historically contributed to an upward trajectory for the fund.

The Importance of Diversification

Investing in VOO stock can serve as an effective strategy for diversification within an investment portfolio. By embracing an index-based investment tactic, investors can reduce individual stock risk while maintaining exposure to the broader market trends. This strategy is particularly advantageous in turbulent market conditions, allowing for a more stable approach to equity investing.

Conclusion: What Lies Ahead for VOO Stock

As we look ahead to the remainder of 2023 and beyond, VOO stock is positioned as a strong investment option for both seasoned and new investors. With continued market recovery, technological innovation, and broad economic improvements, forecast models suggest a positive outlook for the fund. For those looking to invest in the U.S. market with a reliable, low-cost option, VOO stock remains an attractive choice amid fluctuating market conditions.