An In-Depth Look at CIBC Stock Performance in October 2023

Introduction to CIBC Stock

The Canadian Imperial Bank of Commerce (CIBC), one of Canada’s leading financial institutions, has been under the financial spotlight as investors seek opportunities amidst fluctuating market conditions. Understanding CIBC’s stock performance is crucial for investors looking to make informed decisions in the financial sector. As of October 2023, the stock’s movements have raised questions about its future trajectory, particularly in light of economic indicators and sector developments.

Current Performance Overview

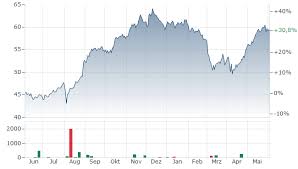

As of late October 2023, CIBC’s stock (stock symbol: CM) has experienced significant price fluctuations. The stock opened the month at approximately CAD $57.25 and has seen a modest increase of about 2% over the subsequent weeks. This change can be attributed to various factors, including quarterly earnings reports, shifts in interest rates, and broader trends in the Canadian banking sector.

On October 25, 2023, CIBC announced its Q3 earnings, revealing a net income of CAD $1.4 billion, a slight decrease compared to the same quarter in 2022. Analysts attribute this decline to increased provisions for credit losses, reflecting a cautious outlook on potential economic headwinds. Despite this, the earnings report was viewed positively by some investors, suggesting that CIBC’s fundamentals remain strong amidst the prevailing economic climate.

Market Environment and Future Outlook

The Canadian banking sector has generally been facing pressures from rising interest rates and inflationary concerns. The Bank of Canada has indicated a pause in interest rate hikes for the time being, which may benefit CIBC and its peers, allowing for a more stable lending environment. However, as inflation persists and the cost of living rises, banks remain vigilant to potential defaults and economic slowdowns.

Market analysts predict that the performance of CIBC stock will largely depend on the bank’s ability to navigate these challenges. If CIBC can sustain its dividend payments and manage risk effectively, it may see continued investor interest, especially from those seeking yield in a volatile market. Furthermore, any advancements in their digital banking initiatives are likely to bolster investor confidence.

Conclusion

In conclusion, CIBC stock has shown resilience despite challenges in the current market environment. Investors should keep a close watch on upcoming economic indicators, industry trends, and CIBC’s strategic moves to ensure they remain well-informed in their investment decisions. Keeping an eye on quarterly earnings and macroeconomic conditions will be essential for those looking to invest in CIBC stock in the coming months.