Alibaba’s Cloud Computing and AI Innovations Drive Remarkable Stock Performance

Strong Market Performance and Strategic Growth

Alibaba’s shares experienced a remarkable surge, jumping 19% following impressive results from its cloud computing division and developments in AI investments. This significant move represents the stock’s strongest performance since March.

While the company reported revenue of 247.65 billion Chinese yuan, slightly below analyst expectations, the cloud computing segment showed accelerated growth, with AI-related revenue maintaining triple-digit year-over-year growth.

Cloud Computing and AI Innovation

The cloud computing division generated revenue of 33.4 billion yuan, marking a 26% year-on-year increase – a significant acceleration from the previous quarter’s 18% growth rate. This division is increasingly viewed as crucial for Alibaba’s AI monetization strategy, similar to tech giants Microsoft and Google.

While focusing on open-source AI solutions, Alibaba also commercializes AI services through its cloud unit. The company has maintained triple-digit year-over-year growth in AI-related product revenue for eight consecutive quarters. The cloud unit’s profitability has also improved, with adjusted earnings before interest, taxes, and amortization rising 26% year-on-year.

Analyst Outlook and Future Prospects

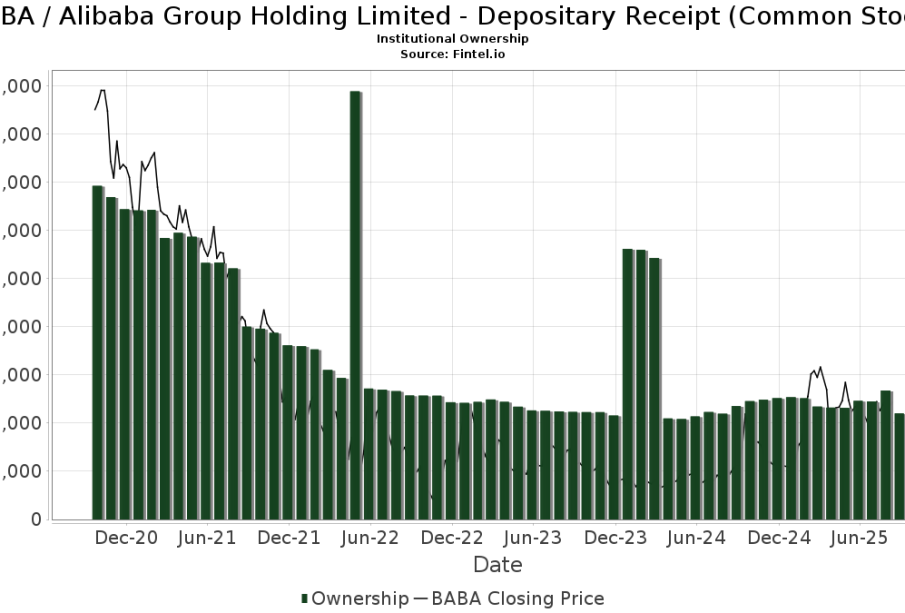

According to 13 analysts, BABA stock currently maintains a “Strong Buy” rating, with a 12-month price target of $163.42, suggesting a potential increase of 17.95% from current levels.

Alibaba continues to balance investments in artificial intelligence and new e-commerce models while maintaining growth in China’s competitive market. This strategy has been well-received by investors, contributing to a 40% rally in its U.S.-listed stock this year, supported by continued growth acceleration in cloud computing and improvements in both domestic and international e-commerce operations.