A Deep Dive into the Dow Jones Index

Introduction to the Dow Jones Index

The Dow Jones Industrial Average (DJIA), commonly known as the Dow Jones, is one of the most iconic stock market indices in the world. Established in 1896, it serves as a barometer for the U.S. economy, reflecting the performance of 30 large publicly owned companies traded on the New York Stock Exchange and the NASDAQ. The significance of the Dow Jones Index lies in its ability to provide investors with a snapshot of market trends and investor sentiment, influencing both local and global financial markets.

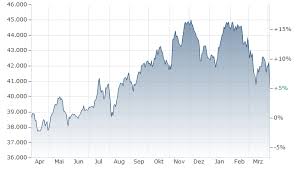

Recent Performance and Trends

As of late October 2023, the Dow Jones Index has seen significant fluctuations due to various macroeconomic factors, including rising interest rates, inflation concerns, and geopolitical tensions. Recently, the index had risen by over 3% month-to-date, driven by strong corporate earnings reports from key constituents such as Microsoft and Apple. Analysts attribute this uptick in stock prices to robust consumer demand and strategic cost management by companies amid economic uncertainty.

Moreover, the Federal Reserve’s decisions regarding interest rates have profound implications on the stock market, especially for index heavyweights. Recently, the Fed hinted at a possible pause in rate hikes, which was met positively by investors, further contributing to the upward movement of the Dow.

Impact on Investors and the Economy

For everyday investors, the performance of the Dow Jones Index can have significant implications for investment strategies. It influences retirement funds and investment portfolios, as many investment vehicles are tied to the performance of the DJIA. A rising Dow typically indicates a thriving economy and encourages more capital inflow into equities, while a declining Dow may persuade investors to pull back and seek safer investment channels.

Conclusion

In summary, the Dow Jones Index continues to be a pivotal instrument in understanding market dynamics and economic health. Investors should remain cognizant of market trends, as fluctuations can signal broader economic shifts. Going forward, analysts predict that the Dow will be closely watched as it reacts to ongoing developments in monetary policy, corporate earnings, and global events. For those tracking their investments, monitoring the Dow can offer valuable insights and foresight in making informed financial decisions.