A Deep Dive into Oklo Stock: Trends and Future Outlook

Introduction

The performance of Oklo stock has recently garnered attention among investors as the company makes strides in the nuclear energy sector. With increasing global demand for sustainable energy solutions, Oklo, a company focused on advanced micro-reactors, represents a promising investment opportunity. As countries strive to reduce carbon emissions and transition towards cleaner energy sources, understanding the dynamics of Oklo stock becomes crucial for investment decisions.

Recent Developments

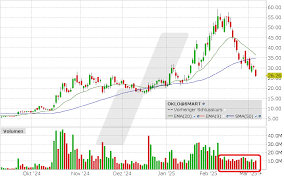

In 2023, Oklo announced significant advancements in its technology, prompting a spike in its stock price. The company’s innovative approach to nuclear energy, particularly with its compact, low-cost reactor designs, has positioned it well within the growing renewable energy market. On September 12, 2023, Oklo reported a successful demonstration of its reactor design, which attracted substantial media coverage and boosted investor confidence. Following this announcement, the stock saw a 15% increase on the stock market, highlighting strong investor interest.

Moreover, strategic partnerships with energy providers and government contracts have further solidified Oklo’s standing in the industry. In August, Oklo signed a memorandum of understanding with a state government aiming to deploy its reactors in remote areas, paving the way for expanded operations and potential revenue growth.

Market Sentiment

Despite the positive outlook, market analysts urge caution. As of October 2023, Oklo stock remains volatile, influenced by broader market trends and fiscal policies that could impact investments in the energy sector. Several analysts have issued mixed reviews, with some emphasizing the potential for long-term growth and others warning of the inherent risks in the newer technology sector.

Conclusion

For investors, keeping an eye on Oklo’s performance is vital amid the evolving energy landscape. While the stock shows promise due to recent technological advancements and strategic partnerships, potential investors should also consider the market’s volatility and the inherent risks of investing in emerging energy technologies. Looking ahead, if Oklo successfully navigates these challenges and leverages its technological edge, it may well emerge as a leader in the nuclear energy market, making its stock an attractive option for those interested in sustainable energy investments.