A Comprehensive Overview of Asts Stock Performance

Introduction

Asts Stock has become a focal point for investors and market analysts lately due to its fluctuating performance and potential growth opportunities. As the financial landscape evolves, keeping a keen eye on such stocks can be critical for making informed investment decisions. Understanding the driving factors behind Asts Stock’s recent trends and the broader market implications can aid both seasoned investors and novices in navigating their financial journeys.

Recent Performance Highlights

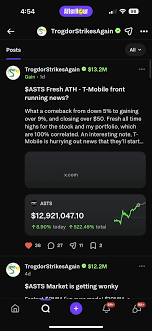

As of October 2023, Asts Stock has demonstrated a series of ups and downs, reflecting broader market conditions and sector-specific developments. Over the last month, the stock has experienced a notable increase of approximately 15%, closing at $18.50 per share. Analysts attribute this rise to several factors including improved quarterly earnings, positive outlooks from key industry players, and renewed investor confidence.

In its latest quarterly report, Asts revealed an earnings per share (EPS) that beat analysts’ estimates by a margin of 20%. The company’s revenue grew 10% year-over-year, primarily driven by an increase in demand for its innovative products. This growth trajectory aligns with several research predictions that anticipated a rebound in sectors most impacted by the pandemic.

Market Trends and Factors Influencing Asts Stock

The recent uptick in Asts Stock can also be linked to emerging market trends. The technology and healthcare sectors are currently witnessing unprecedented growth due to advancements in digital solutions and telehealth services, which have gained widespread acceptance post-pandemic. Investors are increasingly looking to capitalize on stocks positioned favorably in these thriving sectors, leading to heightened interest in Asts.

Furthermore, the company is set to launch new products by early 2024, which analysts believe will further enhance its market standing. Strategic partnerships with other tech giants could also serve as a catalyst for rapid growth, attracting more investors to Asts Stock.

Conclusion

The outlook for Asts Stock remains cautiously optimistic amid a recovering economy and pivotal industry changes. While the stock has shown resilience and potential for growth, investors are advised to conduct thorough research and weigh risks before engaging in the market. Keeping abreast of market trends, regulatory changes, and the company’s strategic initiatives will be critical for stakeholders aiming to make informed decisions regarding Asts Stock in the coming months.