A Comprehensive Look at AAPL Stock and Market Dynamics

Introduction to AAPL Stock

AAPL stock, representing Apple Inc., continues to be one of the most closely watched shares within the technology sector and the overall market. As one of the world’s largest and most valuable companies, Apple’s performance is often seen as a barometer for the tech industry and investor sentiment. Its stock value directly affects not only individual investors but also affects market indexes like the S&P 500 and NASDAQ.

Recent Performance and Market Trends

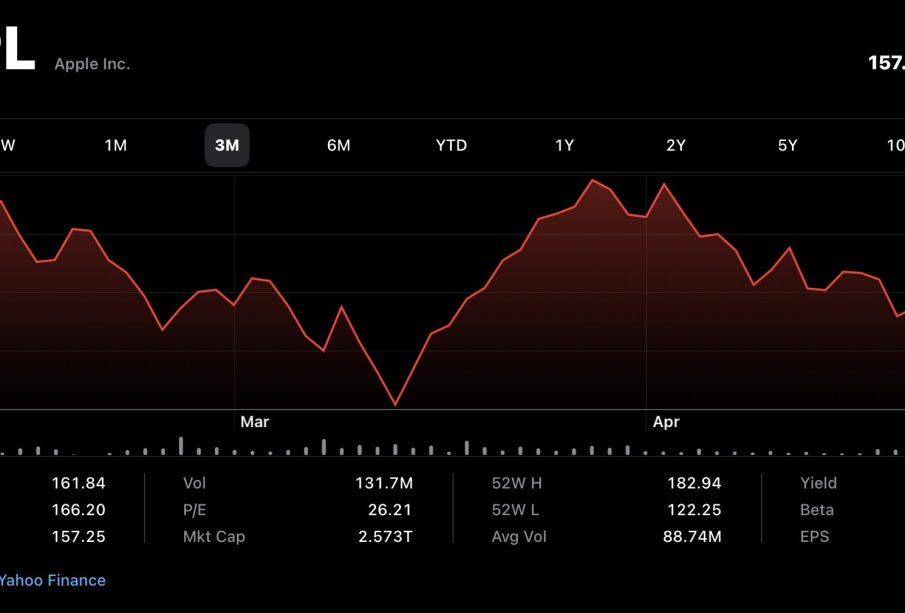

As of early October 2023, AAPL stock is trading at approximately $180 per share, reflecting a year-to-date increase of around 30%. This growth has been driven by strong quarterly earnings, driven by robust iPhone sales and the expansion of services like Apple Music and Apple TV+. Recent reports indicated that Apple’s services segment generated $19.6 billion in revenue last quarter, a significant increase compared to the same period last year.

Moreover, analysts note that investor confidence in Apple has strengthened due to its ability to innovate and adapt to changing consumer demands. The upcoming launch of new products such as the iPhone 15 and advancements in augmented reality (AR) devices have generated considerable buzz, suggesting that the company’s growth trajectory is poised to continue.

Market Impact and Investor Sentiment

The broader market response to AAPL stock cannot be understated. The company comprises a significant percentage of the NASDAQ index, and fluctuations in its stock price often reverberate throughout the technology sector. Analysts at major firms have maintained lofty price targets, some as high as $210 per share, reflecting optimistic projections based on Apple’s growth potential and market penetration.

Moreover, with Apple maintaining a strong cash flow and investing heavily in research and development, many investors see AAPL as a stable choice amidst economic uncertainties. This positioning has made AAPL stock a fixture in many investment portfolios as it is viewed as a relative safe haven.

Conclusion and Future Outlook

In conclusion, AAPL stock remains a significant player in the financial markets, driven by a compelling mix of innovation and consumer loyalty. As Apple continues to roll out new products and services, analysts and investors will closely monitor its stock performance for future cues. With the holiday season approaching and new product launches expected, forecasts suggest that AAPL could see continued upward momentum. For investors, understanding the trends and dynamics around AAPL stock is crucial as it continues to be a leading indicator of both the tech sector and the broader market sentiment.