A Comprehensive Guide to CPP Payments in Canada

Introduction

The Canada Pension Plan (CPP) is a vital part of Canada’s social security framework, providing financial support to millions of Canadians in retirement. As the aging population increases, understanding CPP payments and their significance becomes even more relevant for current and future retirees. This article explores the fundamentals of CPP payments, recent changes, and what they mean for Canadians.

What is the Canada Pension Plan?

The Canada Pension Plan is a government-sponsored pension program that ensures contributors receive a stable income upon retirement. Established in 1966, the CPP mandates contributions from all employed individuals in Canada, with self-employed individuals also making contributions. This system aims to provide a source of retirement income, disability benefits, and survivor benefits.

How CPP Payments Work

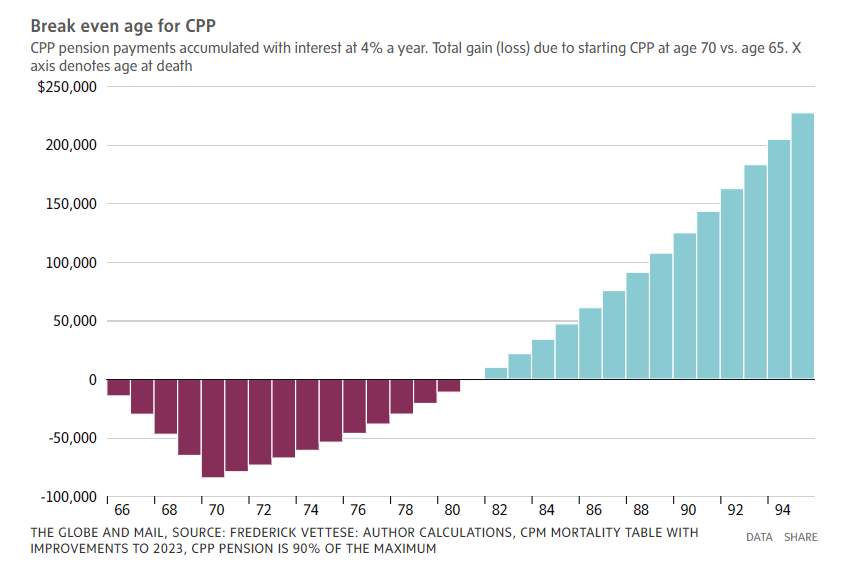

CPP payments are calculated based on the number of years an individual has contributed to the plan and the amount contributed. Currently, individuals can begin receiving their CPP pensions anywhere between ages 60 and 70, with payments adjusting according to the age at which benefits are claimed. For instance, receiving benefits earlier at age 60 results in lower monthly payments, while delaying benefits until age 70 yields a higher monthly allowance.

Recent Changes to CPP Payments

In recent years, the Canadian government has introduced several changes to enhance the CPP for future retirees. In 2016, a plan to gradually increase the contribution rates started, with expectations to increase the CPP payouts by 50% for future recipients. This change ensures that Canadians will receive a more substantial pension as part of their retirement planning.

Importance of CPP Payments

CPP payments are crucial for financial stability in retirement. They serve as a primary income source for many seniors, helping them manage daily expenses, healthcare, and housing costs. Moreover, CPP benefits are indexed to inflation, ensuring that recipients maintain their purchasing power over time.

Conclusion

In conclusion, understanding CPP payments is essential for all Canadians planning for retirement. As changes to the CPP enhance benefits for future retirees, it becomes increasingly important to assess individual retirement plans and contributions. As the landscape of retirement benefits evolves, being informed about CPP payments will help Canadians navigate their financial futures, ensuring a secure and stable retirement.