Understanding Canada Bank Interest Rates in 2023

Introduction

The fluctuating landscape of bank interest rates in Canada plays a crucial role in shaping the national economy.

Interest rates influence borrowing costs for consumers and businesses alike. As of late 2023, the Bank of Canada has faced significant pressure to adjust key interest rates in response to inflation and economic recovery post-pandemic.

Recent Changes in Interest Rates

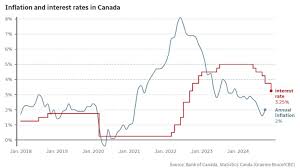

In a recent announcement, the Bank of Canada decided to hold the benchmark interest rate at 5.0%, a decision influenced by the continuing inflationary pressures across various economic sectors. This rate has seen multiple increases over the last year, which were implemented to combat rising consumer prices, which surged to levels not seen in decades.

This significant interest rate hike—part of a series of adjustments—has had a profound impact on mortgage rates and variable loans across the country, making borrowing costlier for Canadians. Notably, the average mortgage rate has climbed significantly, reflecting these changes.

Impact on Consumers and Businesses

As interest rates remain elevated, consumers are starting to see the effects in their monthly payments. The Canadian Real Estate Association has reported a slowdown in home sales as higher borrowing costs discourage new buyers. Homeowners with variable-rate mortgages are particularly impacted, facing increased monthly payments that strain budgets.

Businesses also feel the repercussions, with many citing hesitance to expand or invest due to the increased costs of financing. Smaller enterprises, which often rely on loans to fund operations, find themselves in precarious financial situations. Business confidence is declining as these factors create uncertainty in the marketplace.

Future Outlook

Looking ahead, economists predict that the Bank of Canada may continue to monitor inflation carefully before making further rate adjustments. If consumer spending drops significantly or signs of recession emerge, the central bank might reconsider its position.

The road ahead remains speculative, and experts advise consumers to stay informed about ongoing economic indicators and their potential impacts on interest rates. Following trends in unemployment, inflation, and global economic conditions will be essential for anticipating future changes.

Conclusion

Understanding Canada’s bank interest rates is vital for consumers and businesses alike as these rates dictate the broader economic environment. With current rates affecting everything from mortgages to business loans, it is crucial for Canadians to be proactive in managing their financial strategies amidst these changes.