Current Trends and Future of Uber Stock

Introduction to Uber Stock

Uber Technologies Inc., known for revolutionizing transportation, has become a significant player in the global stock market since its IPO in May 2019. The performance of Uber’s stock is closely monitored by investors due to its implications for the tech industry and gig economy. As we progress into 2023, understanding the dynamics affecting Uber stock is critical for investors considering tech investments in the new economy.

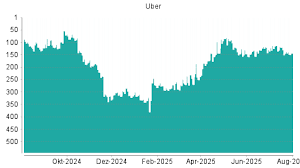

Recent Performance and Market Analysis

As of October 2023, Uber’s stock (NYSE: UBER) has shown resilience amid various market pressures, including rising interest rates and inflation. The stock has experienced fluctuations, but its recent quarterly earnings report has provided a positive outlook. According to the earnings call held in early October, Uber reported a revenue increase of 29% year-on-year, totaling $9.6 billion in Q3 2023. This growth is attributed largely to a surge in demand for Uber Eats and rides.

Analysts have noted that despite the competitive landscape, Uber’s strategic investments in expanding its delivery services and exploring options for autonomous vehicles have solidified its market position. The company has also focused on maintaining driver satisfaction and improving customer experience, which are crucial factors that drive usage and loyalty.

Future Forecasts for Uber Stock

Market analysts remain cautiously optimistic regarding the future of Uber stock. According to market forecasts, Uber’s stock is expected to rise as it continues to optimize its operations and expand its consumer base. Several investment firms have issued buy ratings, with price targets predicting growth between $45 to $55 per share within the next 12 months, contingent on regulatory developments and economic conditions.

Moreover, Uber’s initiative to generate revenue from Uber freight and partnerships in the delivery sector are seen as significant growth avenues. The company has also hinted at new features and enhancements to its app, aiming to diversify its service offerings and enhance user engagement further.

Conclusion

As Uber navigates the complexities of the gig economy and evolving market dynamics, its stock performance continues to be a topic of interest for investors. With promising quarterly results and a solid growth strategy in place, Uber stock may represent a valuable opportunity for those looking to diversify their portfolios. However, as with all investments, potential investors are advised to conduct thorough research and consider the inherent risks before entering the dynamic world of tech stocks.