Current Trends and Insights on WMT Stock

Introduction

Walmart Inc. (WMT), a leading player in global retail, has been one of the most closely watched stocks in recent years. As a bellwether for consumer spending trends, fluctuations in WMT stock are of significant interest to investors, analysts, and consumers alike. With changes in retail dynamics, fiscal policy, and consumer behavior, understanding WMT stock performance offers critical insights into wider economic conditions.

Current Performance and Recent Developments

As of October 2023, WMT stock has seen a notable uptick, trading around $160, representing a roughly 10% increase from earlier in the year. This increase can be attributed to Walmart’s continued investment in e-commerce, enhanced by significant partnerships and innovations in logistics. In August 2023, Walmart announced its improved quarterly earnings, showcasing a 5% year-over-year growth in revenue, further bolstered by its growing presence in online grocery and delivery services.

Furthermore, the retail giant has emphasized cost-cutting measures and optimizing its supply chain, which have positively impacted profit margins. These strategic moves highlight Walmart’s adaptability in a rapidly changing retail landscape.

Market Response and Analyst Insights

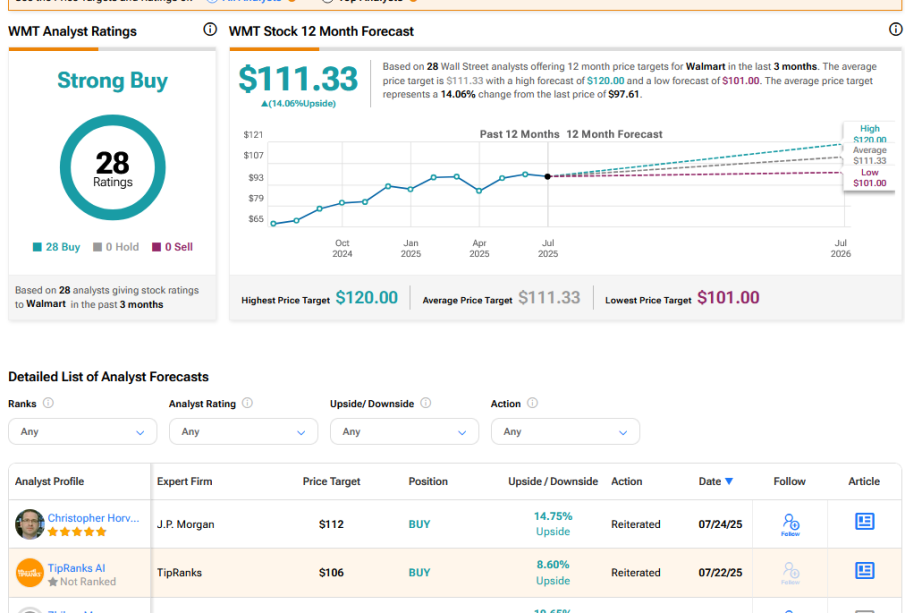

Market analysts have remained cautiously optimistic about WMT stock’s trajectory. According to a recent report from Morgan Stanley, Walmart is well-positioned to capitalize on the increasing shift toward online shopping, with a price target of $175 within the next 12 months. Analysts point to the company’s robust loyalty programs and enhanced customer engagement strategies as key drivers of future growth.

Moreover, credit rating agencies have kept a stable outlook on Walmart’s credit ratings, affirming the company’s resilience in various market conditions. This stability attracts many investors looking for a reliable stock in an unpredictable market.

Conclusion

The performance of WMT stock continues to be a significant indicator within the retail sector and offers insights into the economy at large. As Walmart adapts to changing consumer preferences and invests in growth areas like e-commerce and technology, it is likely to maintain its pivotal role in the market. For investors, monitoring WMT stock not only provides a glimpse into the health of retail but also acts as a barometer of consumer confidence and spending trends going forward. Overall, while uncertainties such as economic fluctuations and competition persist, Walmart’s strategic maneuvers signify a promising outlook for WMT stock in the near future.