Understanding QQQ Stock: Recent Performance and Implications

Introduction

As investors navigate the fluctuating stock market, understanding the performance and trends of specific investments is crucial. One of the most popular exchange-traded funds (ETFs) tracking the tech-heavy Nasdaq-100 Index is the Invesco QQQ Trust, commonly referred to as QQQ stock. With technology evolving rapidly and influencing market dynamics, QQQ plays an essential role in investors’ portfolios and is a significant barometer for tech sector performance.

Recent Performance of QQQ Stock

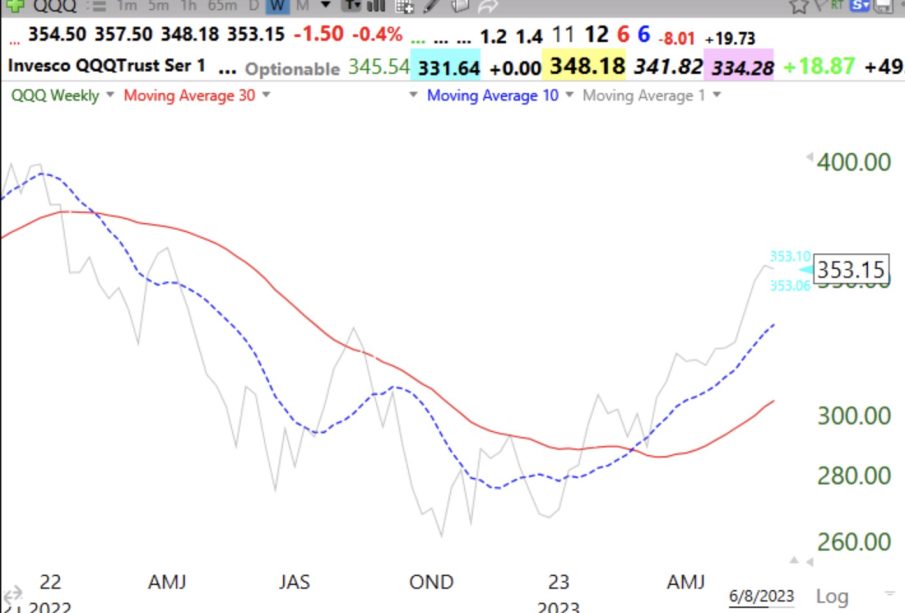

As of October 2023, QQQ stock has demonstrated noteworthy volatility, reflecting broader market trends influenced by interest rates and economic forecasts. After reaching an all-time high in early 2023, the stock has faced some downward pressure due to rising inflation concerns and potential Federal Reserve policy changes.

In the last quarter, QQQ stock was seen trading around $346, experiencing a near-term dip of approximately 10% from its peak. Analysts attribute this decline to investor caution stemming from economic uncertainties, although many remain optimistic about QQQ’s long-term growth potential, given its focus on key technology giants such as Apple, Microsoft, and Amazon.

Factors Influencing QQQ Stock

The performance of QQQ stock is intricately linked to several factors:

- Technology Sector Growth: As technology continues to expand, companies in this ETF benefit from innovation and demand for new solutions.

- Earnings Reports: Quarterly earnings of the underlying companies significantly impact investor sentiment and stock price movements.

- Macroeconomic Indicators: Interest rates, inflation rates, and overall economic health can sway investor decisions and, by extension, QQQ’s performance.

Conclusion and Future Outlook

Looking ahead, analysts suggest that QQQ stock may rebound as the market adjusts to economic shifts and as technology continues to drive growth in various sectors. Moreover, one distinguishing feature of this ETF is its ability to capture the essence of the technology-driven economy, making it a critical asset for growth-focused investors.

Investors should remain vigilant by keeping abreast of market trends, interest rate policy updates, and the performance of major tech corporations. Given its historical performance and relevance, QQQ stock is expected to remain a focal point for those seeking exposure to the technology sector in the coming months.