Understanding the Canada Pension Plan: Updates and Significance

Introduction

The Canada Pension Plan (CPP) is one of the most crucial components of Canada’s social security system, providing financial support to workers upon retirement. With changing demographics and economic conditions, the relevance of CPP has never been more significant, as millions of Canadians depend on it for their financial security in retirement. Recent updates to the plan have drawn attention, making it essential for Canadians to understand how these changes could impact their future benefits.

Recent Developments

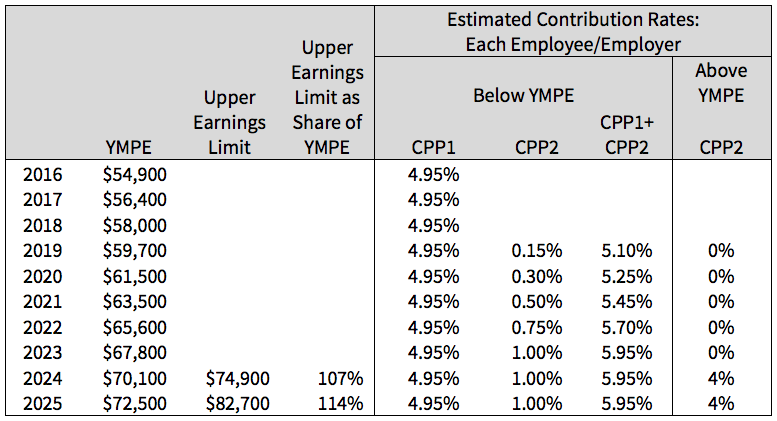

As of 2023, the Canada Pension Plan is undergoing various reforms aimed at ensuring its sustainability and adequacy. In March 2023, the Government of Canada announced an increase in the pension amounts provided under CPP, which will rise by an estimated 25% over the next five years. This increase is a response to rising living costs and aims to provide a more substantial safety net for retirees.

Additionally, recent studies have indicated that by the year 2030, the number of Canadians aged 65 and over is expected to surpass 9 million, accounting for more than 25% of the population. This shift ensures that the CPP will face increasing demand, and as such, it is crucial for individuals to stay informed about how to maximize their future benefits.

Impacts on Canadians

The adjustments to the CPP aim to alleviate anxiety surrounding retirement income, particularly for those who are self-employed or have inconsistent earnings, as these individuals often face more challenges in saving adequately for retirement. The CPP provides a baseline income, ensuring that Canadians can maintain a decent living standard.

Moreover, with rising inflation rates and increased living costs, the reform measures have been lauded as necessary steps to provide a more robust safety net. Financial experts encourage Canadians to regularly review their pension predictions and consider additional saving plans, as the CPP is not designed to fully cover all retirement expenses.

Conclusion

As Canada continues to adapt to its aging population, the Canada Pension Plan remains a pillar of financial security for millions of Canadians. Understanding the implications of the recent updates and preparing for retirement accordingly is vital. Looking ahead, it is expected that the government may continue to tweak the CPP system to ensure its sustainability. This highlights the importance for Canadians to stay informed, participate in pension planning, and make the most of the evolving provisions offered by the Canada Pension Plan.