Analyzing Home Depot Stock: Current Trends and Future Outlook

Introduction

As one of the largest home improvement retailers in the world, Home Depot’s stock is closely watched by investors and market analysts. The company’s performance is not only influenced by consumer spending in the home improvement sector but also by external economic factors such as interest rates and housing market trends. In this article, we will explore the latest trends in Home Depot stock, the factors affecting it, and what the future may hold for investors looking to buy or hold shares in this retail giant.

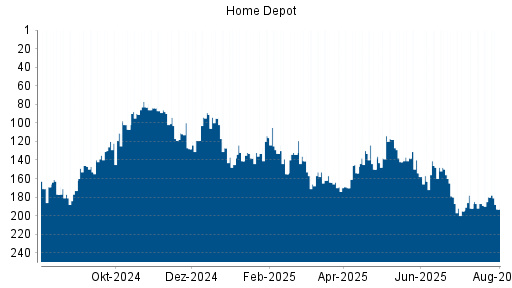

Recent Stock Performance

Home Depot (NYSE: HD) has seen significant volatility in its stock price over the past year, reflecting both the broader market conditions and specific challenges within the retail sector. As of October 2023, Home Depot’s stock was trading around $320 per share, a decline of approximately 10% from its previous year’s high of $355. This drop can be attributed to various factors, including rising inflation, interest rate hikes, and changing consumer behavior post-pandemic.

Factors Influencing Home Depot Stock

1. **Economic Conditions**: The state of the economy plays a crucial role in Home Depot’s performance. Changes in interest rates directly impact mortgage rates, influencing the housing market and consequently, home improvement spending. Recent hikes in interest rates have led to a slowdown in housing sales, which may restrict growth for retailers like Home Depot.

2. **E-commerce Growth**: As consumer shopping habits shift towards online purchasing, Home Depot has been expanding its digital footprint. The company reported that online sales accounted for over 20% of total sales in its most recent earnings report, a trend that is likely to continue as more consumers opt to shop online for home improvement products.

3. **Seasonal Trends**: Home Depot’s performance is often seasonal, with spring and summer being peak periods for home improvement activities. The early indications from the spring 2024 selling season, including weather patterns and consumer enthusiasm, will be critical to watch in the upcoming months.

Looking Ahead

Analysts are divided on the future of Home Depot stock. Some project that as housing market conditions stabilize, demand for home improvement products will rebound, leading to improved sales figures. Others, however, caution that inflationary pressures and interest rate uncertainties might continue to affect consumer spending negatively.

In conclusion, while Home Depot’s stock presents both challenges and opportunities, the ongoing shifts in the economic landscape and consumer behavior make it a compelling subject for investment analysis. Investors should remain informed about market trends and fundamental analysis before making decisions regarding Home Depot stock. With the right strategy, investors might find value in this retail giant even amid economic fluctuations.