Understanding Loblaws Stock: Recent Trends and Insights

Introduction

Loblaws, a major Canadian supermarket chain owned by Loblaw Companies Limited, plays a significant role in the retail market. As one of the largest grocery chains in Canada, Loblaws is well-known for its wide range of products and services, making it a key player in the Canadian economy. The performance of Loblaws stock is crucial for investors and market watchers, particularly as consumer habits evolve and more Canadians shift towards online shopping.

Current Stock Performance

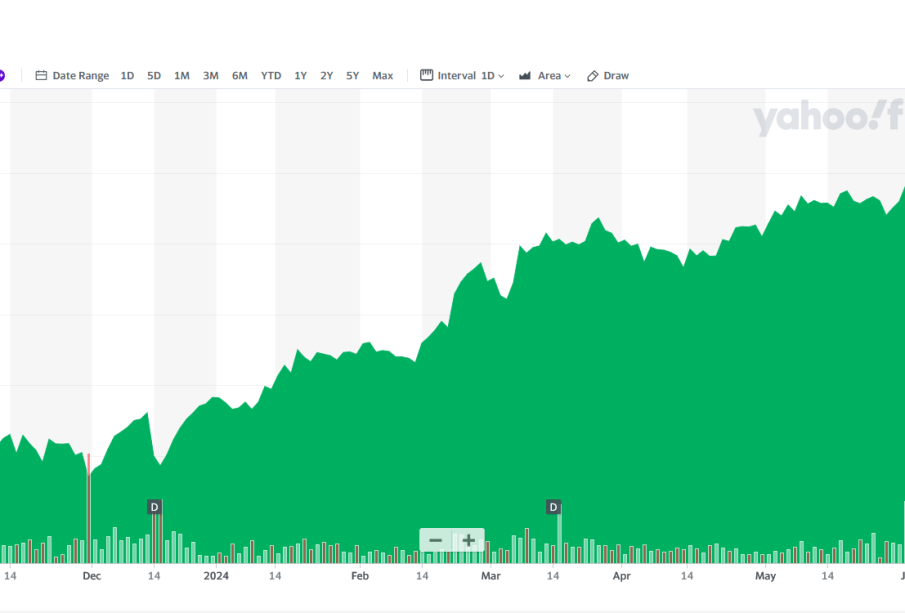

As of October 2023, Loblaw Companies Limited’s stock has shown noteworthy resilience despite the broader market fluctuations. The stock trades on the Toronto Stock Exchange under the ticker symbol ‘L’. In recent weeks, Loblaws has experienced a slight increase in share value, closing at CAD 93.50, reflecting a market capitalization of approximately CAD 31 billion.

In response to shifting consumer spending patterns, particularly in the wake of the COVID-19 pandemic, Loblaws has expanded its online grocery shopping options. This strategic move is credited with enhancing customer experience and retaining market share amidst increasing competition from discount retailers and e-commerce giants.

Strategic Initiatives

To adapt to the changing retail landscape, Loblaws has invested in technological advancements and supply chain optimization. The introduction of the PC Express program has improved online shopping efficiency, allowing customers to order groceries for pickup or delivery. Moreover, recent collaborations with local farms and sustainability initiatives reflect a commitment to quality and responsiveness to consumer demands.

Additionally, Loblaws has been focusing on private label products, which are often cheaper for consumers and provide higher margins for the company. These products are increasingly becoming a staple in Canadian households, thereby boosting sales and consumer loyalty.

Market Analysis and Predictions

Market analysts maintain a positive outlook on Loblaws stock for the upcoming quarters. Factors contributing to this optimism include the company’s strong financial health, consistent revenue growth, and adaptability to consumer trends. Industry experts project that, as grocery prices continue to rise, Loblaws is likely to benefit from increased foot traffic due to its combination of affordability and quality.

Conclusion

In conclusion, Loblaws stock remains a vital point of interest for investors amid a transforming retail landscape in Canada. Its commitment to technological innovation, effective supply chain management, and focus on customer-centric initiatives reflects a forward-thinking approach that positions Loblaws favorably in the market. As trends evolve, keeping an eye on Loblaws stock can provide valuable insights into the broader retail sector and the economic dynamics at play.