An Overview of Meta Stock Performance and Market Trends

Introduction

Meta Platforms, Inc., commonly known as Meta, has recently caught the attention of investors and analysts alike as it navigates the dynamic landscape of the technology sector. As a major player in social media and virtual reality, understanding Meta stock is crucial for those interested in the tech market. Its impact on global communications, advertising, and emerging technologies like the metaverse makes it an essential topic for both seasoned investors and newcomers.

Recent Developments

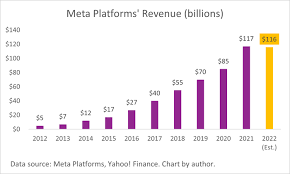

As of October 2023, Meta stock has experienced significant fluctuations influenced by a range of factors including earnings reports, market sentiment, and strategic initiatives in areas like artificial intelligence and augmented reality. The company reported mixed third-quarter earnings, with revenues slightly below expectations but a strong forecast for the upcoming holiday season, reflecting continued growth in advertising revenue.

The stock has shown resilience amid challenges such as regulatory scrutiny and competition from other social media platforms. In August 2023, Meta launched a new suite of tools aimed at enhancing user engagement, which has positively impacted market confidence. Analysts noted that the company’s investments in the metaverse could drive long-term growth, making it an appealing option for future-minded investors.

Market Trends and Analysis

According to market analysis, as of now, Meta stock is trading at approximately $306 per share, a notable recovery from earlier lows. This rise has been attributed to a broader trend in tech stocks recovering from the post-pandemic slump. The company’s diverse portfolio, including Instagram, WhatsApp, and Oculus virtual reality, provides various revenue streams, which is a positive indicator for potential investors.

Furthermore, the influence of economic indicators such as inflation rates and interest rates on stock performance remains a critical consideration. With the Federal Reserve indicating a potential pause in interest rate hikes, many investors are consequently reassessing tech stocks, leading to a cautious optimism surrounding Meta’s future.

Conclusion

In summary, Meta stock remains a crucial subject for those tracking the technology and investment sectors. While recent earnings reports have demonstrated some volatility, the stock is noted for its potential for long-term growth due to the company’s ongoing investments in innovative technologies. As Meta continues to evolve in the realms of social media and immersive technology, it is likely that investor interest in Meta stock will remain high, presenting both opportunities and risks.