Current Trends in Apple Stock Price: An Investor’s Guide

Introduction

The stock price of Apple Inc. (AAPL) continues to capture the attention of investors and market analysts alike. As one of the leading technology companies in the world, fluctuations in Apple’s stock price often signal broader trends in the tech sector and consumer electronics market. In recent weeks, shifts in Apple’s stock price have been influenced by various factors, including product launches, earnings reports, and macroeconomic conditions.

Recent Performance

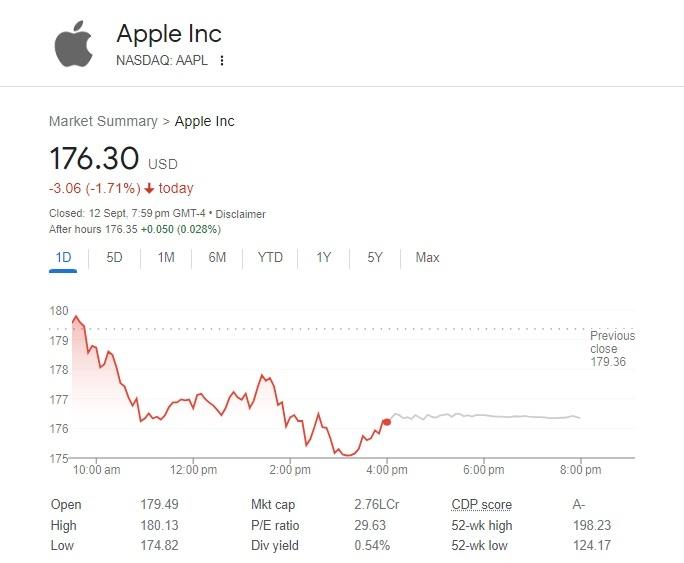

As of mid-October 2023, Apple’s stock price has shown notable volatility, trading around $174 per share. This figure represents a series of peaks and troughs over the last three months, with a 52-week high of $182 and a low of $129. The recent surge has been attributed to the launch of the iPhone 15, which has received positive reviews and is expected to boost sales during the holiday season.

Key Factors Influencing Price Movements

1. Product Innovations

Apple’s reputation for innovation directly affects its stock performance. The successful introduction of new products, particularly in wearables and services, can lead to an influx of investor confidence. Analysts predict that the ongoing expansion of Apple’s services segment—accounting for nearly 20% of total revenue—will add further stability to its stock.

2. Economic Indicators

Global economic conditions also play a critical role in shaping Apple’s stock price. Changes in interest rates, inflation, and consumer spending directly impact the company’s performance. Recent reports suggest that consumer spending remains robust, providing a favorable environment for Apple’s sales growth.

3. Competition and Market Trends

Apple faces intense competition from other technology giants, like Samsung and Google, which influences its market share and profitability. Analysts are closely monitoring how Apple responds to these competitive threats, especially as the market shifts toward artificial intelligence (AI) and other emerging technologies.

Conclusion

In conclusion, Apple’s stock price remains a critical indicator for investors and a barometer for the technology sector. With the release of new products and favorable economic conditions, analysts are hopeful that Apple will maintain its upward trajectory. However, potential investors should remain vigilant about the competitive landscape and macroeconomic factors that could impact stock performance. Moving into 2024, the focus will be on how well Apple can capitalize on its innovative capabilities while navigating the challenges of a rapidly changing market environment.