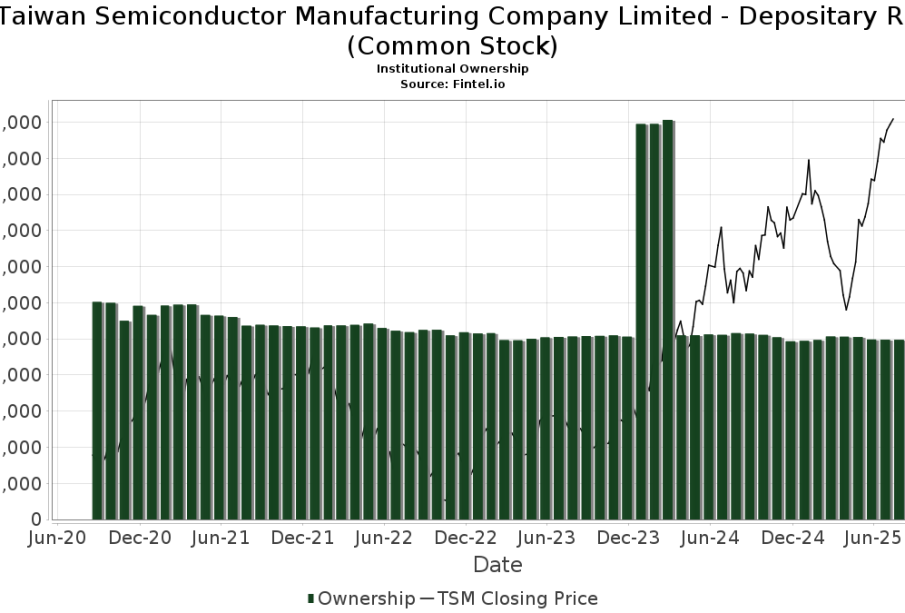

TSM Stock: Latest Performance and Market Insights

Importance of TSM Stock

TSM stock, representing Taiwan Semiconductor Manufacturing Company (TSMC), is a critical player in the global semiconductor industry. As a leading foundry for semiconductor fabrication, TSMC produces chips for major technology companies, making its stock closely watched by investors and analysts alike. Recent developments in the tech landscape, including advancements in artificial intelligence and 5G technology, have further heightened the relevance of TSM stock.

Recent Developments

As of October 2023, TSM stock has shown significant movement following both quarterly earnings reports and shifts in the semiconductor market. In Q3 2023, TSMC reported an impressive revenue of $18.1 billion, a 24% year-over-year increase, largely attributed to robust demand for high-performance computing and mobile devices. With the ongoing global chip shortage and increasing investments in technology infrastructure, the outlook remains positive.

Market Trends Impacting TSM Stock

Analysts cite several factors influencing TSM stock movements. Firstly, the surge in AI capabilities has prompted tech companies to invest heavily in chip production, thus increasing demand for TSMC’s fabricated semiconductors. Additionally, TSMC’s efforts to enhance its fabrication technologies, including the development of 3nm chips, bolster its competitive edge against rivals.

Conclusion and Future Outlook

Looking ahead, TSM stock is anticipated to play a significant role in the ongoing technology evolution. Analysts project continued strong performance into 2024, with expectations that revenue will exceed $75 billion by the end of the fiscal year. Moreover, as countries like the United States and those within the EU push for semiconductor self-sufficiency, TSMC could benefit from increased international investments. For investors and stakeholders, following TSM stock’s trajectory will be crucial in understanding the broader tech sector’s future.