Insightful Analysis on INTC Stock Performance

Introduction

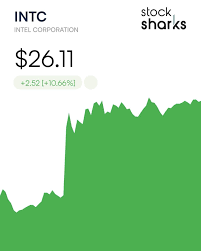

Intel Corporation, known by its stock ticker INTC, has been a focal point for investors and tech enthusiasts alike. The company, a leader in semiconductor manufacturing, has experienced significant fluctuations in its stock price recently. Understanding the dynamics around INTC stock is crucial for investors looking to navigate the complex world of technology stocks.

Recent Performance Trends

As of October 2023, INTC stock has shown a promising uptrend, driven by various factors including robust demand for chip technology and recent innovations in AI and cloud computing. The stock is currently trading at approximately $33, reflecting a notable rebound from its lows in earlier quarters of the year.

Intel’s latest quarterly earnings report highlighted a revenue increase of 12% compared to the previous quarter, driven by strong sales in its datacenter and AI segments. Analysts are optimistic, estimating that with the increasing reliance on AI technology, particularly in data centers and edge computing, demand for Intel’s products will continue to rise.

Market Implications

Investors are closely monitoring external factors influencing INTC stock, including global supply chain challenges and competition from rival companies like AMD and NVIDIA. In response, Intel has announced substantial investments in expanding its manufacturing capabilities to mitigate supply shortages and keep up with competitors. The company’s $20 billion investment in new plants in Ohio is a strategic move aimed at solidifying its market position and boosting production capacity.

Future Outlook

Looking ahead, analysts predict that as Intel continues to execute its turnaround strategy, the stock could see further appreciation. Key indicators to watch include upcoming product releases, advancements in chip technology, and ongoing developments in the semiconductor industry as a whole. With a focus on AI and high-performance computing, INTC stock will likely remain an essential consideration for both current and prospective investors.

Conclusion

In conclusion, INTC stock represents an interesting opportunity amid a rapidly evolving tech landscape. While challenges remain, Intel’s proactive measures and strategic investments could position it favorably in the long term. Investors must stay informed about market trends and Intel’s innovation trajectory to make educated decisions about their portfolios. Following INTC stock performance will be essential as the tech industry continues to adapt and grow.