IonQ Stock: A Look into the Future of Quantum Computing

Introduction

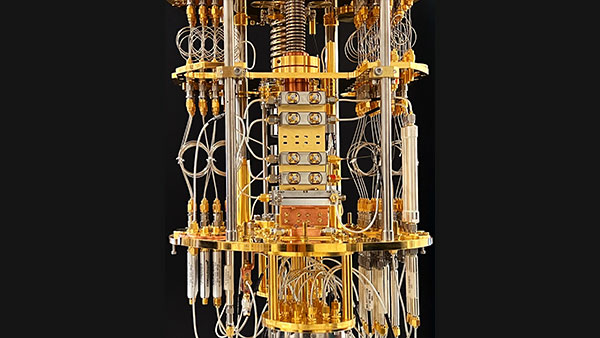

In an era where technology is evolving at an unprecedented pace, quantum computing has emerged as a game-changer. IonQ, a leading player in this sector, is attracting significant attention from investors. Understanding the performance and potential of IonQ stock is crucial for anyone interested in the tech industry’s new frontier.

Recent Performance and Market Trends

As of October 2023, IonQ’s stock has shown a volatile but promising trajectory. The company, which went public in 2021 via a merger with a special purpose acquisition company (SPAC), has faced its share of challenges, including market fluctuations influenced by broader economic conditions. Recent reports indicate that IonQ’s stock is currently valued at approximately $15.50 per share, reflecting a recent increase of 5% over the past month.

One key driver of IonQ’s stock performance is the growing demand for quantum computing solutions across various industries, including pharmaceuticals, finance, and logistics. Companies like Google and IBM have invested heavily in quantum research, contributing to a flourishing market expected to reach $65 billion by 2030. IonQ’s focus on providing accessible quantum computing through cloud services has placed it in a competitive position.

Financial Health

In terms of financial health, IonQ reported revenue of $9.5 million for the second quarter of 2023, a notable increase compared to the previous year’s figures. While still operating at a loss due to investment in research and development, analysts project that the company could achieve profitability within the next few years as technology matures and client bases expand.

Future Prospects and Risks

Looking ahead, IonQ’s potential is bolstered by strategic partnerships and advancements in their technology. Collaborations with major tech firms and continued innovation in quantum algorithms could enhance their market position. However, investors should remain cautious—risks such as competition from other quantum computing firms and regulatory uncertainties could impact IonQ’s growth trajectory.

Conclusion

Overall, IonQ stock presents both opportunities and challenges for investors. As quantum computing continues to gain traction and the market evolves, IonQ’s focus on innovation and strategic partnerships may pave the way for long-term success. For those interested in tech investments, keeping an eye on IonQ could prove beneficial as the company navigates this cutting-edge sector.