Understanding the Recent Trends in Uber Stock

Introduction

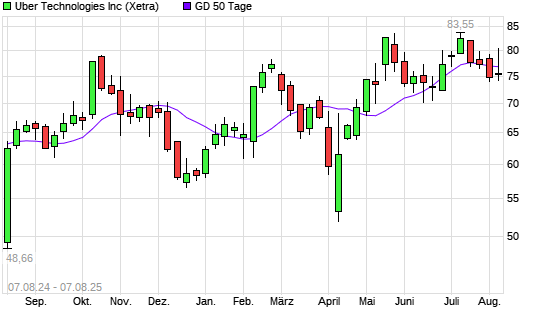

Uber Technologies, Inc. has become a significant player not only in the ride-sharing industry but also on the stock market since its IPO in 2019. Investors closely watch Uber’s stock as it reflects broader trends in transportation technology and e-commerce. With recent advancements in its business model and market shifts, the performance of Uber stock has become a focal point for analysts and shareholders alike.

Recent Developments

As of October 2023, Uber’s stock has seen notable fluctuations due to several factors impacting its performance. The company’s transition towards profitability, a focus on food delivery through Uber Eats, and its venture into freight services have all contributed to its market standing. In the most recent earnings report, Uber announced a 15% increase in revenue year-over-year, reaching $9.8 billion for the third quarter. This has been partly attributed to its expanding international markets and a broader rebound in travel.

However, challenges remain. The competitive landscape in the ride-sharing sector is intensifying with new entrants and changes in regulatory environments. Additionally, concerns over rising fuel costs and driver shortages continue to challenge profitability despite revenue growth.

The Market Reaction

Investors have responded positively to Uber’s latest performance indicators, with the stock price rising approximately 20% in the past month alone. Analysts have upgraded their ratings from hold to buy, anticipating that the company’s strategic initiatives will further enhance its market position. Still, some analysts caution that while the short-term outlook appears promising, long-term sustainability hinges on Uber’s ability to navigate evolving market dynamics and operational challenges.

Conclusion

In conclusion, Uber stock remains a critical barometer of the evolving tech-driven transportation landscape. With a significant uptick in revenue and positive market reactions, Uber is poised for potential growth. However, investors are encouraged to monitor the competition and operational challenges that may impact its future performance. As Uber continues to adapt and innovate, its stock will likely remain a subject of keen interest among both retail and institutional investors.