Understanding Mortgage Interest Rates: Current Trends and Effects

The Importance of Mortgage Interest Rates

Mortgage interest rates play a crucial role in the real estate market and the overall economy of Canada. These rates determine the cost of borrowing money to purchase a home, impacting how much potential buyers can afford. With fluctuating rates, current homebuyers and those looking to refinance are particularly affected. In recent months, rising interest rates have become a significant topic of discussion among financial experts and homebuyers alike.

Current Trends in Mortgage Interest Rates

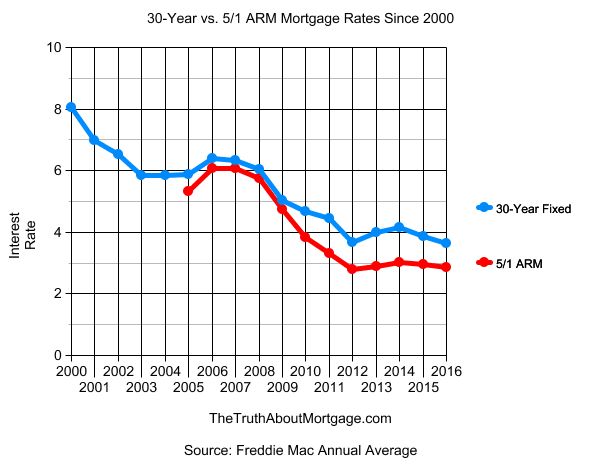

As of late 2023, the Bank of Canada has adopted a more hawkish stance on interest rates to combat inflation, resulting in successive rate hikes throughout the year. According to the latest data, average fixed mortgage rates have climbed to around 5.8%, significantly higher than the previous year when rates hovered near record lows. Variable rates have also increased, although they remain slightly lower than fixed rates. These changes make it more challenging for first-time homebuyers to enter the market, as higher rates translate to larger monthly payments.

According to the Canadian Mortgage and Housing Corporation (CMHC), the increase in rates has led to a cooling housing market, with home sales declining by approximately 20% compared to 2022. Many buyers are now opting to wait it out in hopes of more favorable market conditions before making a purchase. Additionally, lenders have tightened their criteria for mortgage approval, further complicating the situation.

The Impact on Consumers and the Housing Market

With the recent hikes in mortgage interest rates, many Canadians are re-evaluating their financial strategies. For homeowners looking to refinance, the higher rates may discourage them from taking action, as potential savings could be overshadowed by increased borrowing costs. Furthermore, consumers are likely to see a greater divide in the housing market as those who are already in their homes may choose to stay put due to uncertainty.

Conclusion and Future Outlook

As the Bank of Canada prepares for potential further rate adjustments, the outlook for mortgage interest rates remains uncertain. Experts suggest that unless inflation is brought under control, the upward trajectory of mortgage rates could persist. For potential homebuyers and current homeowners, staying informed about market trends and understanding personal finance will be crucial in navigating the evolving landscape of mortgage interest rates. With housing affordability taking center stage, it becomes increasingly important for policy-makers to balance economic growth with sustainable housing options for all Canadians.