Lulu Stock Updates: Performance and Future Prospects

Introduction to Lulu Stock

Lulu (LULU) is a well-known athletic apparel brand that has gained significant popularity in recent years, especially among fitness enthusiasts. The company is listed on the NASDAQ stock exchange and has shown notable stock performance driven by strong consumer demand and clever marketing strategies. Understanding the current trends related to Lulu stock is critical for existing investors and potential buyers alike. This article examines recent developments affecting Lulu stock, its performance trends, and future forecasts.

Recent Performance and Market Trends

As of October 2023, Lulu stock has shown resilience despite market fluctuations influenced by broader economic conditions. Year-to-date, shares have gained approximately 25%, primarily fueled by the company’s expansion in international markets and the launch of new product lines that cater to evolving customer preferences. In the most recent earnings report, Lulu reported a 20% increase in revenue compared to the previous year, with a significant boost in online sales.

The company’s direct-to-consumer model has proven effective, with e-commerce sales accounting for over 40% of total revenue. This shift towards digital has not only increased customer engagement but also improved profit margins significantly, as the company reduces reliance on third-party retailers. Analysts predict that this trend may continue, positioning Lulu favorably in the competitive landscape of athletic apparel.

Challenges Ahead

Despite the positive trajectory, Lulu faces challenges that could affect its stock performance in the future. Supply chain issues stemming from global disruptions continue to pose risks, potentially impacting inventory and delivery times. Additionally, increasing competition from established brands and emerging startups in the athleisure space could lead to market saturation and pressure on pricing. The recent economic downturn has also seen some consumers cut discretionary spending, which may impact premium brands like Lulu.

Future Outlook for Lulu Stock

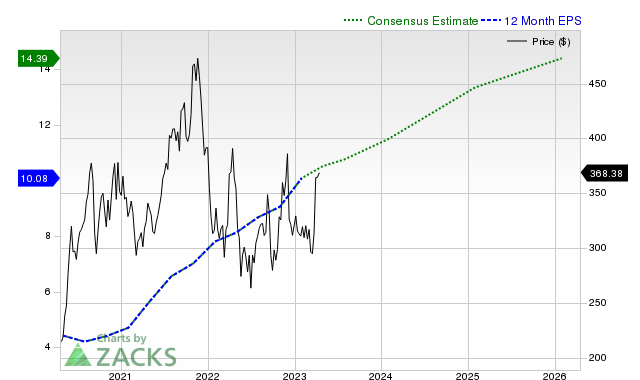

Looking ahead, analysts remain optimistic about Lulu stock, with a consensus target price projecting a significant upside based on its solid fundamentals and growth prospects. Strategies involving sustainability initiatives and community engagement campaigns are expected to resonate well with environmentally conscious consumers, enhancing brand loyalty.

In conclusion, while Lulu stock has demonstrated strong growth and has navigated the complexities of the current market effectively, careful attention must be paid to external challenges. Investors should keep a close watch on the company’s ability to adapt to emerging market dynamics. Overall, Lulu remains a compelling option for stock investors with an eye on the athletic apparel sector.