Latest Trends in Hims Stock: What Investors Need to Know

Introduction

The health and wellness industry has witnessed a significant transformation in recent years, and companies like Hims & Hers Health, Inc. (Hims) have become prominent players. As a telehealth company specializing in men’s and women’s health products, Hims has attracted considerable attention from investors. Understanding the trends surrounding Hims stock is crucial for potential investors and market watchers, especially in the wake of a tumultuous economic environment influenced by interest rates and consumer spending habits.

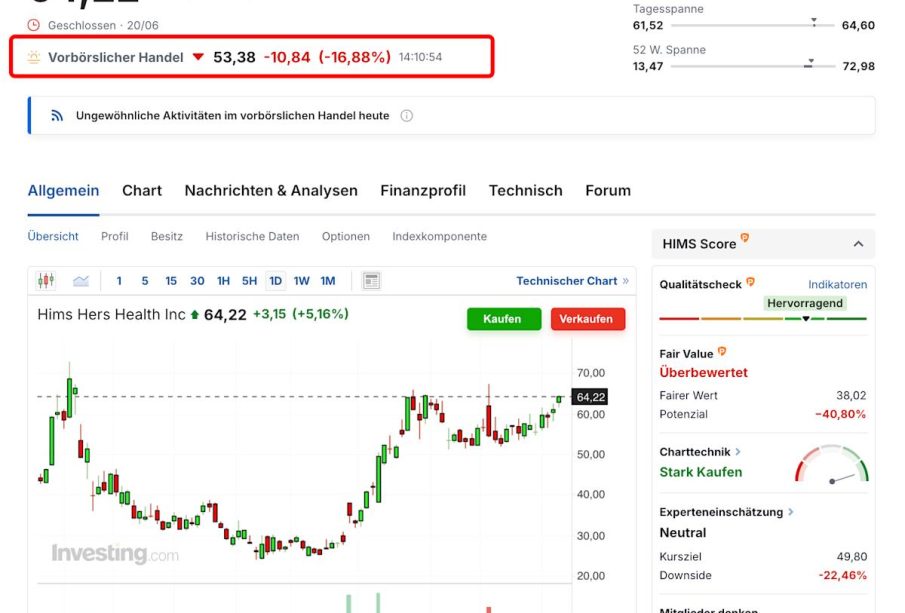

Recent Performance of Hims Stock

As of early October 2023, Hims stock (HIMS) has shown volatility but remained a topic of interest among investors. The stock was trading around $8.50, reflecting a gain of approximately 15% over the last month, primarily driven by the company’s recent financial disclosures and strategic initiatives aimed at expansion. Hims reported a 25% increase in revenue year-over-year for Q2 2023, largely attributed to the growth in telehealth services. Analysts have expressed optimism about the company’s focus on diversifying its product lines, adding new services, and enhancing its digital platform.

Market Dynamics Influencing Hims

The ongoing trends in telemedicine, particularly post-pandemic, have largely contributed to Hims’ market appeal. The convenience and accessibility of remote health consultations have led to increased consumer adoption. Additionally, shifting consumer attitudes towards proactive healthcare are presenting new opportunities for growth. However, Hims faces stiff competition from other telehealth providers and traditional healthcare systems, which continue to innovate their offerings in response to market demands.

Future Outlook and Significance for Investors

Looking ahead, many analysts are cautiously optimistic about the future of Hims stock. With anticipated developments in regulatory frameworks supporting telehealth and an expanding consumer market for health and wellness products, Hims may continue to see upward momentum. However, potential investors should remain vigilant about the risks associated with market fluctuations and the competitive landscape.

In summary, Hims stock remains a strong contender within the health sector, characterized by recent positive financial performance and considerable market potential. As the telehealth industry evolves, Hims is positioned to capture a larger share of this lucrative market. Investors should weigh the prospects of Hims against evolving economic conditions as they consider their next moves in the stock market.