Fubo Stock: Current Performance and Future Outlook

Introduction

FuboTV Inc. (NYSE: FUBO) has garnered significant attention in the era of cord-cutting and streaming services. As a sports-centric live TV streaming platform, its stock has been a topic of interest for investors looking to capitalize on the ever-evolving media landscape. The importance of understanding Fubo stock lies not only in its performance but also in its implications for the future of television consumption and sports broadcasting.

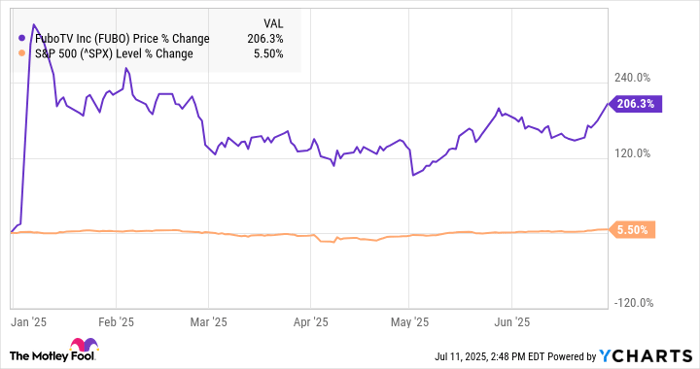

Current Market Performance

As of late November 2023, Fubo stock is trading at approximately $2.50, having experienced fluctuations throughout the year amid broader market volatility. Investors have witnessed both peaks and troughs, with the stock reaching a high of $10 earlier in the year before facing challenges. This decline has been influenced by various factors, including competition from other streaming services, shifts in consumer preferences, and the company’s financial performance.

Recent Developments

Recently, FuboTV announced a strategic partnership with several major sports leagues to enhance their content offerings, solidifying their position in the highly competitive streaming market. The company revealed it would expand its game access, providing subscribers with a wider selection of live sports events. Additionally, Fubo has made headlines for its ongoing efforts to diversify revenue streams, including the introduction of a sportsbook feature to its platform, which aligns with the growing trend of legalized sports betting across the United States.

Financial Overview

Financially, Fubo reported a quarterly revenue of $200 million, marking a year-over-year increase of 25%. However, despite revenue growth, the company continues to struggle with profitability, reporting a net loss of $50 million. Analysts point out that while growth in subscribers has been promising, Fubo’s ability to turn around its operational efficiency will be crucial in attracting and retaining investors.

Future Outlook

Looking ahead, analysts remain cautiously optimistic about Fubo stock, suggesting that the company’s focus on strategic partnerships and expansion into the sports betting market could yield positive results in the long run. The demand for streaming services is expected to continue growing, especially among younger demographics, providing valuable insights for potential investors. As the media landscape continues to shift, FuboTV’s adaptability will play a pivotal role in its success as a player in the streaming industry.

Conclusion

In conclusion, Fubo stock presents both opportunities and challenges for investors. As the company navigates the complexities of the streaming market while striving for profitability, those interested in Fubo should keep a close eye on its strategic initiatives and market performance. The ongoing evolution of consumer viewing habits will significantly influence the future trajectory of FuboTV.