Understanding Air Canada Stock: Trends and Insights

Introduction

Air Canada, the country’s largest airline, plays a crucial role not only in the transportation sector but also in the Canadian stock market. As travel demand surges post-pandemic, investors are increasingly focused on the dynamics of Air Canada stock. Understanding its performance, price fluctuations, and market trends is essential for current and potential investors as they navigate the volatile aviation sector.

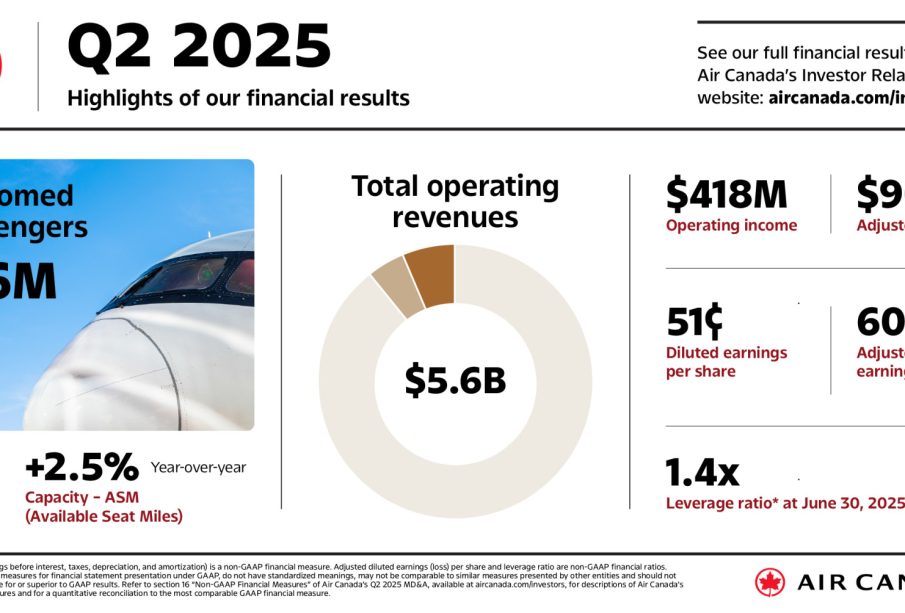

Current Market Performance

As of October 2023, Air Canada’s stock has shown significant volatility. After a severe downturn during the COVID-19 pandemic, the stock has rebounded, with shares trading around CAD 33.00. This is a marked increase compared to previous years, as the airline has successfully capitalized on the resurgence of travel demand. Q3 earnings reports indicating a revenue increase of 21% year-over-year reflect the strong recovery trajectory.

Factors Influencing Air Canada Stock

Several factors are influencing the stock’s performance:

- Travel Demand: The lifting of travel restrictions and a rise in leisure and business travel have positively impacted Air Canada’s revenues.

- Fuel Prices: Rising fuel costs can negatively affect profit margins, a point of concern for many airlines, including Air Canada.

- Market Competition: Increased competition from other airlines in both domestic and international markets is another factor investors should monitor.

- Regulatory Changes: Compliance with new environmental regulations and any governmental initiatives to support the aviation industry can also impact stock performance.

Investing Considerations

For investors considering Air Canada stock, it is vital to analyze both short-term and long-term factors. Analysts suggest keeping an eye on fuel price trends and how quickly the airline can adapt to market changes. The current consensus among financial analysts is that, while the stock shows promise with the recovery in the travel sector, uncertainties like inflationary pressures and operational costs remain significant risks.

Conclusion

In summary, Air Canada stock represents both opportunities and challenges in the current market landscape. As travel continues to recover and the airline navigates through fluctuating operational costs, it is an intriguing option for investors. By keeping abreast of market trends and company performance, investors can make informed decisions about Air Canada stock in the ever-evolving aviation landscape.