Recent Developments in the Bank of Canada Interest Rate

Introduction

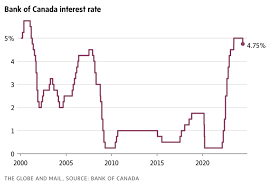

The interest rate set by the Bank of Canada (BoC) holds significant importance for the Canadian economy. As the country’s central bank, the BoC’s decisions on interest rates influence borrowing costs, spending, and inflation, ultimately affecting economic growth. Recently, the BoC has been grappling with inflationary pressures and changing economic conditions, making the topic of interest rates particularly relevant for Canadians.

Current Interest Rate Trends

As of October 2023, the Bank of Canada has maintained its key interest rate at 5.00%. This rate has remained unchanged since the last hike earlier this year, following a series of rate increases aimed at combating persistent inflation, which surged to 7.0% earlier in 2023. The stabilization of the rate reflects the bank’s cautious approach to current economic indicators, including consumer spending and employment metrics.

Economic Factors Influencing the Rate

Several factors contribute to the BoC’s interest rate decisions. Canada has seen fluctuating inflation rates, which have prompted the bank to implement aggressive monetary policy changes over the past years. Factors such as global supply chain disruptions, energy prices, and wages have contributed to higher costs for consumers. The central bank has also considered the effects of the ongoing geopolitical tensions and their potential impact on economic growth.

Predictions and Implications

As economic indicators evolve, market analysts are predicting potential changes to interest rates in the coming months. Some economists forecast that the BoC may begin a gradual reduction of interest rates towards the end of 2024, if inflation continues to stabilize around the bank’s target of 2.0%. However, others caution that unexpected economic shocks or rapid inflationary pressures could necessitate further rate hikes.

Conclusion

The Bank of Canada’s interest rate is a critical gauge of the nation’s economic health and financial stability. With the current rate holding steady amidst looming inflation concerns, Canadians must stay informed of how these rates may impact their financial decisions, such as mortgages and loans. Understanding the BoC’s approaches not only helps individual financial planning but also provides insight into the broader economic landscape. As the situation continues to evolve, all eyes will be on the BoC’s next moves and the overall implications for the Canadian economy.