First National: Transforming Canadian Real Estate Services

Introduction

First National Financial is a staple in the Canadian real estate landscape, recognized for its critical role in providing mortgage solutions and real estate financial services. Established in the early 1980s, First National has evolved into one of Canada’s largest non-bank mortgage lenders, making its mark by offering competitive rates and a diverse range of mortgage products. As the real estate market continues to change amidst economic fluctuations, First National’s services hold essential relevance for both homebuyers and investors.

Growth and Services

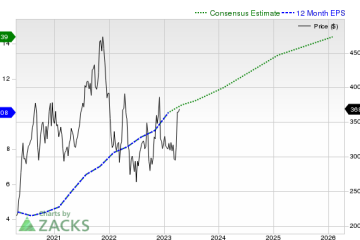

First National’s growth trajectory has been notable, with its portfolio expanding to over $118 billion in mortgages across Canada as of 2023. With a focus on residential and commercial mortgages, the company has garnered a reputation for efficiency and customer satisfaction. By utilizing advanced technology platforms, First National enables seamless transactions, setting new benchmarks for service quality in the industry.

Moreover, the firm offers expert services in mortgage underwriting and administration, which helps streamline the lending process for brokers and clients alike. Their emphasis on building strong relationships with brokers across the country has proven integral, facilitating a more localized understanding of market needs.

Current Trends and Impact

In recent months, First National has adapted its strategies in response to rising interest rates and shifting market dynamics. As the Bank of Canada continues to adjust its rates to combat inflation, homebuyers face increased pressure on affordability. To help navigate these changes, First National has introduced products aimed at providing greater flexibility, such as adjustable-rate mortgages and innovative repayment options.

Additionally, the company is actively engaged in sustainability initiatives, aligning itself with the growing importance of environmentally-conscious practices within the real estate sector. First National’s commitment to green financing options exemplifies its dedication to both community and corporate responsibility.

Conclusion

As First National continues to innovate and adapt, its role in the Canadian real estate market becomes increasingly vital. The company’s responsive strategies reflect its understanding of market realities, ensuring that it provides relevant and effective solutions to mortgagors and investors alike. Looking ahead, First National’s continued growth and enhanced services are likely to influence the broader real estate ecosystem, making it a focal point for industry stakeholders and consumers. With ongoing commitment to excellence, First National is poised to navigate the complexities of the Canadian real estate landscape while fostering a brighter financial future for its clients.