Understanding American Eagle Stock Performance and Trends

Introduction

The performance of American Eagle Outfitters Inc. (NYSE: AEO) stock has garnered significant attention in 2023 due to the evolving retail landscape and shifts in consumer behavior. As a leading retailer in the apparel sector, American Eagle’s stock serves as a barometer for investor sentiment towards retail companies thriving amidst economic uncertainty. Understanding its recent trends is crucial for investors considering whether to buy, hold, or sell their shares.

Recent Performance and Market Analysis

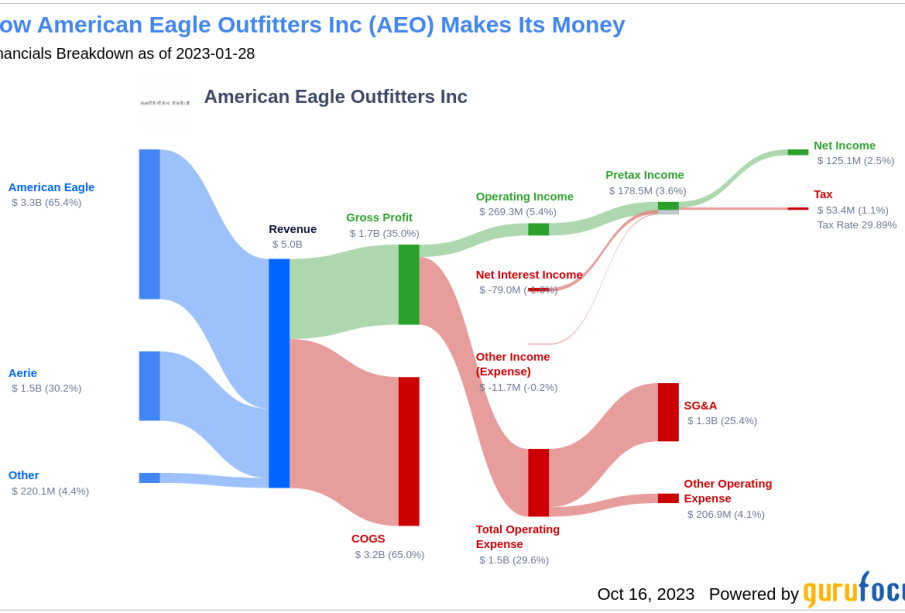

As of October 2023, American Eagle stock has experienced fluctuations largely driven by factors such as earnings reports, changing consumer spending habits, and rising inflation rates. The company’s stock was reported to be trading around $12 per share, a decline from earlier highs that were observed in 2022. Despite challenges, including supply chain issues and competition from online retailers, American Eagle has adapted its strategies.

In its latest quarterly earnings report, American Eagle announced a 5% year-on-year revenue increase, albeit with a slight decrease in net income. Analysts attribute the revenue growth to a strong holiday season sales increase and improvements in the ongoing live shopping initiatives, which have resonated well with their target demographic of young consumers. This was a refreshing sign considering the uncertainty faced by many retailers in the current economy.

Moreover, American Eagle has maintained a focus on sustainability and inclusivity, leading to a positive brand image and consumer loyalty. Their commitment to eco-friendly products may also play a role in attracting ethically conscious consumers, potentially influencing stock performance favorably in the long run.

Strategic Shifts and Future Outlook

Looking ahead, American Eagle anticipates further strategic shifts aimed at solidifying its market position. The company’s management has indicated plans to enhance online shopping experiences further, streamline supply chains, and expand their product offerings. Industry experts expect that these proactive measures could lead to a stock valuation rebound in the latter part of 2023 and into 2024.

The general outlook for American Eagle stock remains cautiously optimistic, bolstered by the company’s initiatives to navigate the economic complexities. Investors should monitor the retail sector’s overall dynamics, consumer behavior patterns, and macroeconomic indicators impacting discretionary spending on apparel.

Conclusion

In summary, American Eagle stock remains a focal point for investors interested in the apparel retail market. While facing challenges in the current economic environment, the company’s strategic initiatives and consumer engagement tactics may position it for recovery and growth. As retail dynamics continue to evolve, it’s essential for shareholders to stay informed on these trends and adapt their investment strategies accordingly.