Understanding QS Stock: Performance and Future Outlook

Introduction

The stock market’s performance can have significant implications for investors, and one stock that has garnered attention in recent months is QS stock, representing QuantumScape Corporation. QuantumScape, a leader in battery technology, particularly solid-state batteries, is on a path that may reshape the electric vehicle (EV) industry. Analyzing QS stock is crucial for understanding both the current technological advancements and market trends impacting the EV sector.

Recent Performance

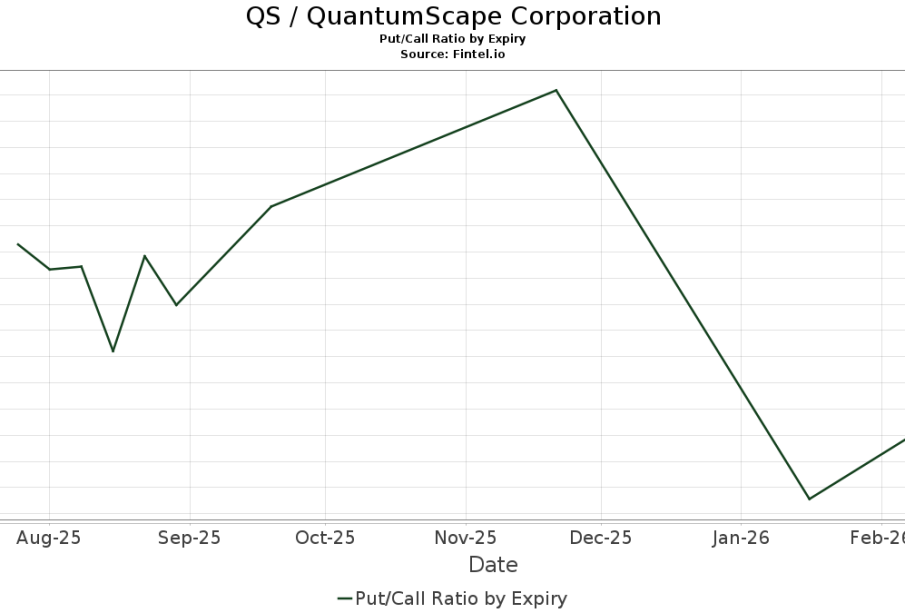

As of October 2023, QuantumScape’s stock has experienced notable fluctuations, reflecting broader market trends and specific corporate developments. After facing challenges post-SPAC merger in late 2020, the stock saw a resurgence due to heightened investor interest in sustainable technology and electric vehicles.

In the last quarter, QS stock reported a price increase of approximately 30%, primarily driven by successful advancements in battery technology and strategic partnerships with major automotive manufacturers. Notably, announcements regarding full-scale production plans have improved investor confidence, indicating potential future revenues. Analysts suggest that the demand for EVs and sustainable energy solutions will correlate directly with the upswing in QS stock prices.

Market Analysis

The landscape for battery technology is intensifying, with competition growing not only from established automotive manufacturers but also from new entrants focusing on solid-state and lithium-sulfur technologies. As per recent evaluations, QuantumScape’s technology could potentially provide faster charging times and longer battery lifespans compared to traditional lithium-ion batteries, making it a key player. The projected growth of the EV market, expected to reach $800 billion by 2028, positions QS stock favorably in the context of overall industry expansion.

Future Outlook

Looking to the future, analysts predict that QS stock will continue to rise as QuantumScape scales its production capabilities. The company’s roadmap includes commercializing its solid-state battery technology by 2024, which is a major milestone for both the company and the industry. Furthermore, a recent partnership with a leading automotive manufacturer for battery supply contracts is expected to enhance revenue potential significantly.

Conclusion

For investors, understanding QS stock is essential given its link to broader trends in renewable energy and electric vehicle adoption. While there are inherent risks associated with emerging technologies, QuantumScape’s innovative approach puts it in a favorable position within a rapidly evolving market. By monitoring the advancements in battery technology and shifting consumer preferences toward EVs, investors may find QS stock a compelling opportunity in the coming years. Ensuring to do thorough research and consider market risks remains crucial for any investment strategy.