Understanding Canada Tariffs: Current Trends and Implications

Introduction

Tariffs in Canada have become a crucial topic of discussion in recent times, especially as the global economy continues to navigate the complexities brought about by the COVID-19 pandemic and changing trade relationships. Understanding tariffs is essential for businesses, consumers, and policymakers since they significantly impact prices, supply chains, and international relations. In recent months, Canada has made headlines with its tariff policies concerning various products and countries, highlighting the need for a comprehensive understanding of current tariff structures and their implications.

Current Tariff Landscape

As of 2023, Canada maintains various tariff levels on thousands of goods imported into the country. According to the Canada Border Services Agency (CBSA), the average most-favored-nation (MFN) tariff is about 4.1%, but it varies considerably by product and country of origin. In response to recent inflation and supply chain disruptions, the Canadian government has introduced temporary tariff relief on essential items like food and household goods to diminish the financial burden on consumers.

Additionally, Canada has been actively involved in resolving trade disputes. The ongoing tensions between Canada and China have led to increased scrutiny of certain Chinese imports, prompting the government to impose tariffs on various products ranging from aluminum to solar panels. These actions are not only retaliatory but also aimed at protecting domestic industries from what the government perceives as unfair trade practices.

Impact on Businesses and Consumers

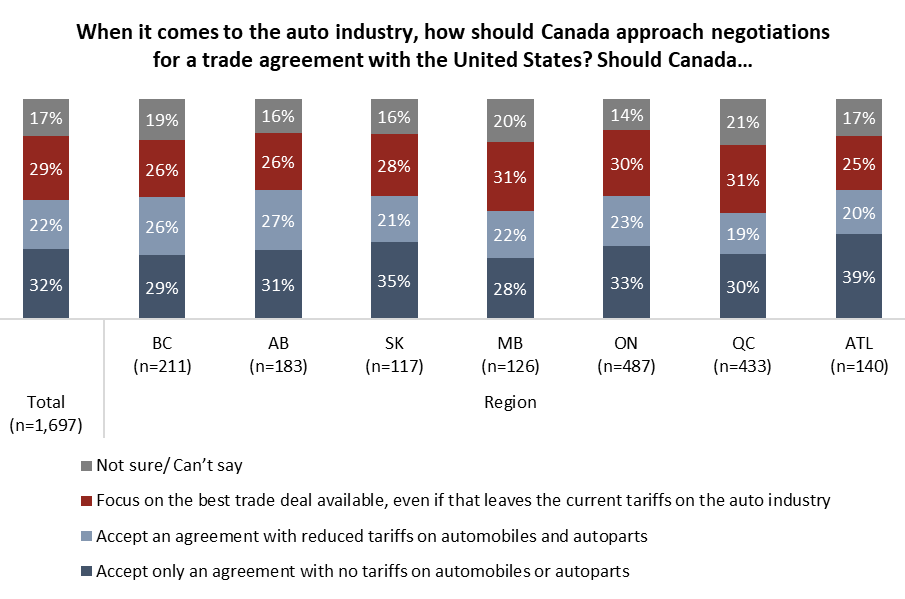

Tariffs have a direct impact on the cost of goods in Canada. Increased tariffs on imported goods often lead to higher prices for consumers, which can result in inflationary pressures. Retailers and manufacturers are forced to navigate these costs, potentially leading to increased prices or reduced profit margins. The electronics and automotive sectors, for example, are particularly sensitive to tariff changes, as components often cross borders multiple times during the production process.

On a positive note, protective tariffs can shield Canadian producers from foreign competition, enabling local industries to thrive. Canadian farmers have benefitted from tariffs placed on foreign agricultural products that compete with local produce, fostering a growing market for domestic goods.

Conclusion

The current status of tariffs in Canada illustrates the delicate balance the government must maintain between protecting domestic industries and ensuring consumer prices remain manageable. As international trade relations continue to evolve, Canadians can expect ongoing adjustments to tariff policies. The significance of understanding these tariffs cannot be understated, as they directly influence economic conditions and personal consumer choices. Future trends may lead to increased negotiations on trade agreements that could further redefine Canada’s tariff landscape, shaping the economic environment for years to come.