SMCI Stock: Current Trends and Future Outlook

Introduction

The stock market is a vital indicator of economic health, influencing investment decisions and financial strategies for individuals and institutions alike. Among the myriad of stocks available, SMCI (Super Micro Computer, Inc.) has gained significant attention recently, primarily due to its role in the burgeoning cloud infrastructure and data center sectors. Understanding the current performance and future potential of SMCI stock is essential for investors looking to capitalize on technological trends.

Current Performance of SMCI Stock

As of October 2023, SMCI stock has shown impressive performance, reflecting the increasing demand for high-performance computing solutions. According to market data, SMCI’s shares have climbed approximately 75% in value since the beginning of the year, outperforming many of its competitors in the tech industry. The company’s strong quarterly earnings reports, which have consistently exceeded analysts’ expectations, have contributed to this upward momentum. In its latest earnings call, SMCI reported a revenue increase of 61% year-over-year, driven by robust sales of server and storage solutions.

Factors Influencing the Stock Value

Several key factors are driving the positive trajectory of SMCI stock:

- Increased Demand for Cloud Solutions: With the rise of remote work and digital transformation, companies are investing heavily in data centers and cloud computing solutions. SMCI is well-positioned to benefit from this trend.

- Technological Advancements: Continuous innovation in AI and machine learning has created a demand for advanced computing solutions, which SMCI specializes in providing.

- Strategic Partnerships: Partnerships with major tech firms have further solidified SMCI’s market position, enhancing its credibility and expanding its customer base.

Future Outlook

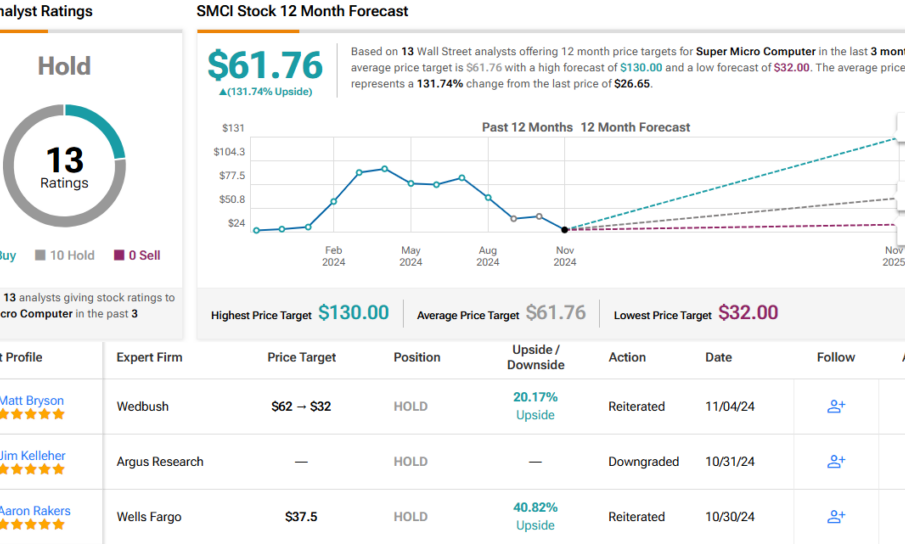

Looking ahead, analysts remain optimistic about the growth potential of SMCI stock. Market predictions indicate that as businesses continue to digitalize, the demand for their products is expected to grow exponentially. Analysts forecast a projected earnings growth rate of over 25% for the upcoming quarters, supported by the ongoing trends in technology and cloud adoption.

Conclusion

In conclusion, SMCI stock is currently a focal point for investors, reflecting significant growth and promising future potential. The convergence of increased data requirements and technological advancements positions Super Micro Computer, Inc. as a key player in the tech landscape. Investors should keep a close eye on SMCI stock as they navigate the dynamic stock market environment, as its performance may provide insights into broader technological trends.