Aritzia Stock: Recent Trends and Future Outlook

Introduction

Aritzia, a popular Canadian fashion retailer, has garnered significant attention in the investment community due to its dynamic market performance. Founded in 1984, the company specializes in women’s clothing and has established a strong brand presence in North America. Understanding Aritzia’s stock performance is essential for investors, as it reflects broader market trends and consumer appetite in the retail sector, especially post-pandemic.

Recent Performance Overview

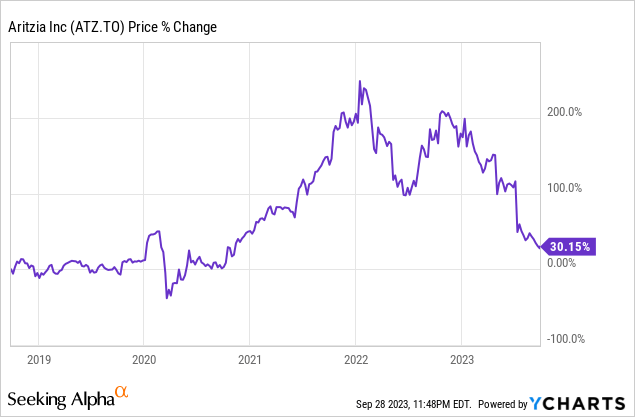

As of mid-October 2023, Aritzia’s stock has faced volatility amid changing consumer behaviors and economic pressures. After going public in 2021 with an initial public offering (IPO) price of $16, the stock hit an all-time high of $54. Aritzia has shown resilience in its recovery following pandemic-induced challenges. According to recent reports, the stock is now trading at approximately $35, reflecting a downward adjustment largely due to concerns over inflation and supply chain issues affecting the retail sector.

The company recently released its quarterly results, reporting a 12% increase in year-over-year revenues, signaling a steady demand for its high-fashion items. However, analysts note that the projected slowdown in consumer spending as inflation rises may impact future sales.

Market Trends and Influences

Investors are paying close attention to the market trends that affect Aritzia’s stock. The fashion retail sector is experiencing shifts, with consumers increasingly favoring online shopping. Aritzia has successfully expanded its e-commerce capabilities, which have significantly contributed to its revenue growth during economically challenging times. This pivot to digital sales is crucial for maintaining a competitive edge against other retailers.

Moreover, the sustainability initiatives that Aritzia has adopted, such as using eco-friendly materials and ethical manufacturing practices, are positively influencing brand loyalty among younger consumers. Reports indicate that companies prioritizing sustainability are likely to see better investment returns in the future.

Conclusion and Future Outlook

The recent performance of Aritzia’s stock illustrates the complexities of investing in retail. While Aritzia has demonstrated growth and resilience, external economic factors remain a significant concern for its stock valuation. Analysts predict that Aritzia may stabilize around the $30-40 mark in the near term as the market adjusts to long-term economic conditions.

For investors, keeping an eye on Aritzia’s quarterly performance, market adaptations, and consumer behavior trends will be crucial in understanding potential stock movements. With its robust brand identity and growing online presence, Aritzia remains a noteworthy entity in the Canadian retail landscape.