Understanding the Ontario Trillium Benefit

Introduction

The Ontario Trillium Benefit (OTB) is a vital financial program designed to assist low- to moderate-income residents of Ontario. It aims to alleviate the financial burden of property taxes, energy costs, and sales taxes. In times of rising living expenses, the relevance of the OTB becomes increasingly important, as it offers support to those most in need.

What is the Ontario Trillium Benefit?

The Ontario Trillium Benefit combines three key components: the Ontario Energy and Property Tax Credit, the Northern Ontario Energy Credit, and the Ontario Sales Tax Credit. Eligible residents can receive this financial aid as a monthly payment which helps to mitigate the costs associated with housing and utility expenses. The OTB is administered by the Canada Revenue Agency (CRA) and is available to eligible residents who file their income tax returns.

Eligibility Criteria

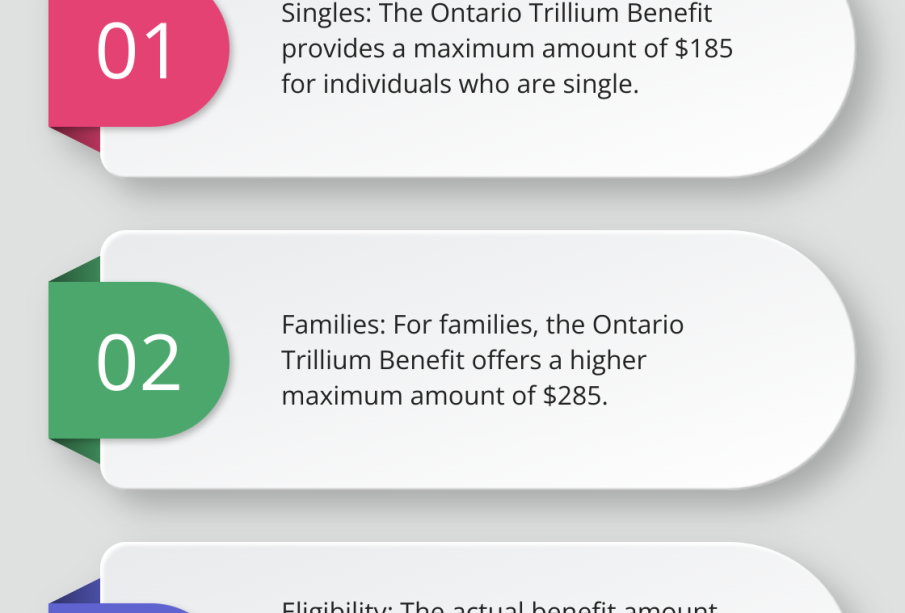

To qualify for the OTB, applicants must be Ontario residents over the age of 18 and have a low to moderate income. The amount of the benefit varies depending on factors such as household income, the number of dependents, and the property taxes paid. Homeowners and renters alike may be eligible, but it is essential to apply annually through the tax return process to receive the benefit. For 2023, the Ontario Trillium Benefit payments can provide up to $1,000 per adult and $300 per child.

Recent Developments

As of 2023, the provincial government has made efforts to streamline the application process and increase awareness about the program. Reports indicate that there has been a recent uptick in applications, suggesting that more residents are seeking this financial assistance amid rising costs of living. The government has also committed to enhancing outreach programs to ensure more Ontario residents are informed about their potential eligibility.

Conclusion

The Ontario Trillium Benefit remains a crucial support system for many Ontarians facing financial hardship. As inflation and living costs continue to rise, the significance of such benefits cannot be overstated. Residents are encouraged to assess their eligibility and take advantage of the available assistance to help improve their financial situation. In the coming years, we can expect possible expansions or adjustments to the OTB as the government assesses the ongoing economic climate and its impact on low- to moderate-income households.