NVDA Stock: Recent Trends and Future Outlook

Introduction

NVIDIA Corporation (NVDA), a leading player in the graphics processing unit (GPU) market, has seen its stock soar dramatically in recent years. This surge has been largely driven by the increasing demand for AI, gaming, and data center applications. With the company’s innovative technology and market dominance, NVDA stock has become a focal point for investors looking to capitalize on the tech sector’s growth.

Recent Performance of NVDA Stock

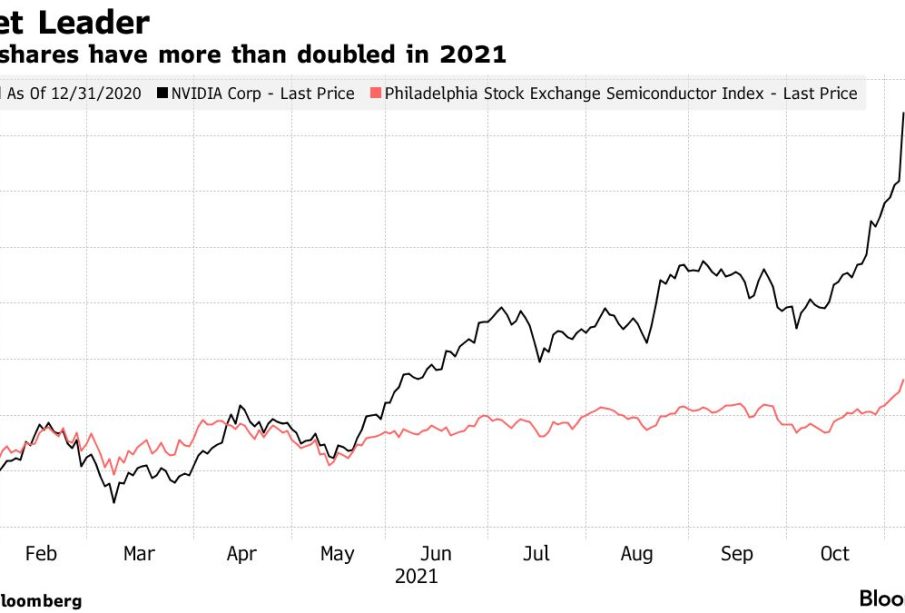

As of October 2023, NVDA stock has recorded a meteoric rise, reaching an all-time high of approximately $500 per share. The company reported a significant increase in revenue, largely attributed to its strong performance in AI computing and gaming segments. In Q2 2023, NVIDIA’s revenue was reported at $9.7 billion, a 101% year-over-year increase, showcasing the company’s robust growth trajectory. Analysts have cited NVIDIA’s dominance in the GPU market, particularly for data centers, as a key driver of this growth.

Market Trends Influencing NVDA Stock

The ongoing AI revolution is a crucial factor influencing NVDA stock. With companies across various industries investing heavily in artificial intelligence technologies, NVIDIA has positioned itself as a market leader with its cutting-edge GPUs. The demand for AI capabilities has led to a burgeoning market for GPU products, further enhancing NVIDIA’s profitability. Additionally, the rise of the metaverse and virtual reality applications have also contributed to increasing sales.

Investors’ Sentiment and Expert Opinions

Investor sentiment surrounding NVDA stock remains overwhelmingly positive. Analysts from several financial institutions have given strong buy ratings, emphasizing the potential for continued growth. The momentum surrounding NVIDIA’s innovations, including advancements in AI and machine learning, supports these bullish outlooks. However, some experts suggest that investors should be cautious, noting that the stock’s rapid climb may lead to heightened volatility in the future.

Conclusion

NVIDIA’s stock represents a compelling opportunity for investors interested in the technology sector. However, potential investors should weigh the current market dynamics and forecasts since factor changes such as regulatory concerns or competitive pressures could affect stock performance. As the demand for AI and machine learning technologies continues to grow, NVDA stock is likely to remain a strong contender for those looking to invest in the future of technology. Staying informed about market trends and corporate developments will be essential for anyone looking to navigate the NASDAQ with NVIDIA’s stock.