Understanding Mogo Stock: Trends and Market Insights

Introduction

Mogo Inc. has emerged as a noteworthy player in the fintech sector, providing innovative financial products and services across Canada. As the company continues to enhance its offerings and expand its user base, the performance of Mogo stock has become a focal point for investors. With a growing emphasis on digital finance solutions, understanding Mogo’s stock trends is vital for those looking to invest in the future of financial technology.

Recent Developments

As of October 2023, Mogo (TSX: MOGO) has seen fluctuating stock prices influenced by a mixture of market dynamics and internal developments. The company’s recent report highlighted a 25% increase in active users, which has drawn the interest of both institutional and retail investors. Mogo’s strategic shift towards cryptocurrencies has attracted attention, particularly following the uptick in interest in digital currencies globally.

Moreover, Mogo’s partnership initiatives, such as offering cryptocurrency services through its platform, further showcase its innovative approach in the competitive fintech landscape. In July 2023, Mogo announced its collaboration with a leading crypto exchange, significantly boosting its digital asset portfolio and enhancing user experience.

Market Performance Analysis

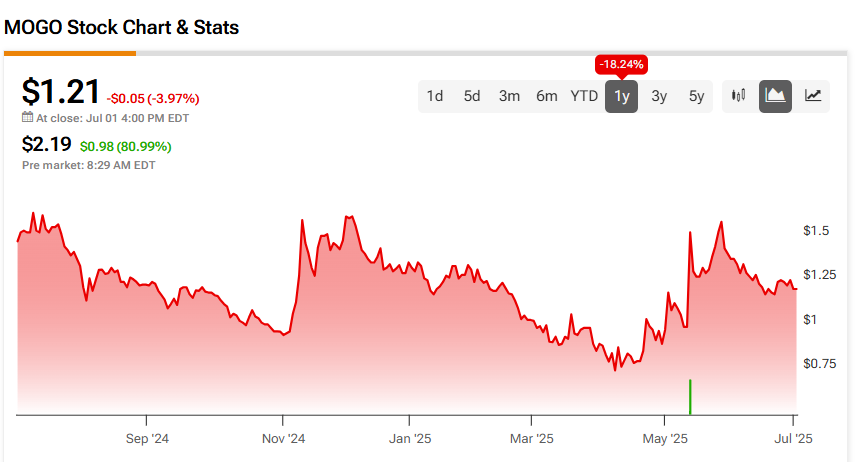

Over the past few months, Mogo stock has experienced volatility, reflecting broader trends in the fintech market. Analysts suggest that the stock’s performance correlates closely with consumer behavior changes towards digital finance and cryptocurrency investments. As of the current quarter, Mogo stock is up approximately 15%, suggesting a positive sentiment among investors after the initial dips earlier in the year.

Market analysts have forecast mixed reviews concerning Mogo’s future stock performance. Some view the strategic focus on cryptocurrency and digital integration as a solid growth avenue, which could lead to potential stock appreciation. However, caution remains with the volatile nature of cryptocurrencies and regulatory considerations that could impact Mogo’s operations.

Conclusion

In conclusion, Mogo Inc. represents a compelling investment opportunity within the fintech sector, particularly for those interested in the integration of traditional banking with modern technological advancements. As market dynamics continue to evolve, potential investors should closely monitor Mogo’s stock performance, keeping an eye on user growth trends and external factors influencing the financial sector. Long-term projections suggest that if Mogo successfully capitalizes on its innovative offerings, the stock could present a lucrative investment as digital finance continues to gain traction globally.