Latest Trends and Insights on BCE Stock

Introduction to BCE Stock

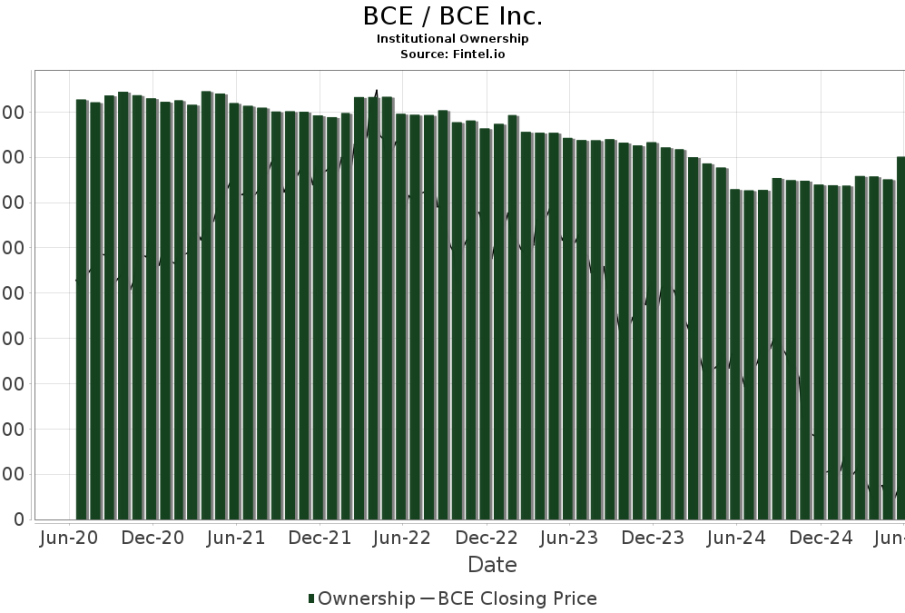

BCE Inc., a major player in Canada’s telecommunications industry, operates under the Bell brand and has been a significant contributor to the economy. As one of the largest telecommunications companies in Canada, BCE stock is closely watched by investors for its performance and dividend yield. The relevance of BCE stock is underscored by its stability and consistent revenue generation, factors that make it a popular choice among both institutional and retail investors.

Recent Performance and Market Trends

In recent months, BCE stock has shown resilience amid a turbulent market environment. As of mid-October 2023, BCE shares were trading at approximately CAD 62, reflecting a slight increase since the beginning of the year. This uptick can be attributed to a variety of factors, including strong quarterly earnings reports and a solid customer base that continues to expand in the wireless and broadband sectors.

In its most recent quarterly earnings, BCE reported revenues of CAD 6 billion, a 3% year-over-year increase. The growth was largely driven by an increase in wireless subscribers, which rose by 5.5% compared to the same quarter last year. This steady growth is seen as a positive indicator for current and potential investors.

Dividends and Investment Outlook

One of the most attractive features of BCE stock is its consistent dividend payments. The company has a long-standing history of increasing its dividends, which currently stands at a yield of around 5.5%. This has made BCE a favored stock among income-seeking investors. Given the company’s track record and financial health, many analysts forecast that BCE will continue to raise its dividends in the coming years, aligning with anticipated growth in cash flow.

Furthermore, amid increasing competition from both traditional and new entrants in the telecommunications sector, BCE is investing heavily in network infrastructure and technology upgrades. This positions the company well to maintain its competitive advantage and meet the rising demand for high-speed internet and digital services.

Conclusion: Why BCE Stock Matters

The significance of BCE stock extends beyond its mere performance metrics. For investors seeking exposure to the Canadian telecommunications market, BCE serves as a cornerstone investment due to its stability, robust dividend history, and continuous innovation. As the company adapts to market changes and technological advancements, the outlook for BCE stock remains positive. Current investors and those contemplating adding BCE to their portfolios should keep an eye on ongoing developments and industry trends that could influence BCE’s performance in the future.