Understanding Google Stock: Market Trends and Future Insights

Introduction

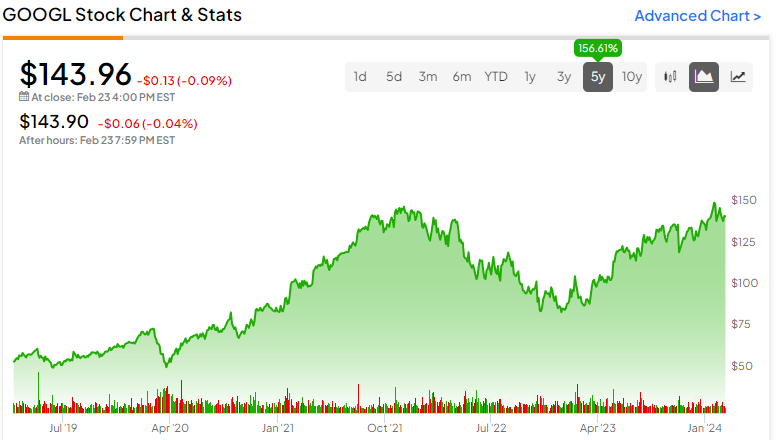

The performance of Google stock has been a significant focal point for investors and market analysts alike. As one of the leading technology companies in the world, Alphabet Inc., the parent company of Google, plays a crucial role in shaping market trends. Recent events such as market fluctuations, earnings reports, and innovative advancements showcase the dynamic nature of Google’s stock outlook.

Recent Performance Trends

In the last quarter alone, Google’s stock has shown remarkable resilience. Following a minor dip in July 2023, shares have rebounded significantly, reflecting a bullish sentiment amongst investors. As of mid-October 2023, Google stock is trading at approximately $140 per share, demonstrating a recovery of nearly 20% since the previous lows.

Two key factors contributing to this upswing include positive earnings results that exceeded Wall Street’s expectations and ongoing developments in artificial intelligence (AI). In their recent quarterly report, Alphabet reported a net income of $19.5 billion, an increase from $18.5 billion in the corresponding period last year, showcasing robust advertising revenues alongside increasing interest in their cloud services.

Market Influences and Innovations

Alphabet’s innovative strides in AI have not gone unnoticed. The recent launch of their AI-powered features in Google Search and the introduction of advanced machine learning tools for businesses have positioned the company as a leader in the technology sector. Users and businesses alike are increasingly turning to Google’s solutions, potentially driving future revenue growth.

In addition to AI, Alphabet has been expanding its reach in the health tech industry, promising long-term growth. The creation of platforms such as Google Health demonstrates Alphabet’s strategy to diversify its business model and create additional revenue streams, which bodes well for their stock performance.

Conclusion and Future Outlook

Looking ahead, analysts remain optimistic about Google stock’s trajectory. With a strong fiscal performance, innovative product offerings, and a diversified business strategy, Google appears well-positioned to capitalize on future market opportunities. Investors should pay close attention to upcoming developments, particularly in AI and health tech, as these areas are expected to greatly influence Google’s growth potential.

In conclusion, Google stock remains a compelling choice for investors looking for stable growth in the tech sector. As industry dynamics evolve, keeping track of Google’s innovations and market responses will be essential for informed investment decisions.