Understanding Visa Stock: Trends and Market Insights

Introduction

Visa Inc. is a global leader in digital payments, facilitating transactions among consumers, merchants, financial institutions, and government entities. As a part of the financial services sector, Visa’s stock performance is closely monitored by investors and analysts alike, making it a pivotal component of many investment portfolios. In light of recent market fluctuations and innovations in payment technologies, understanding Visa’s stock is essential for both seasoned investors and novices.

Current Market Performance

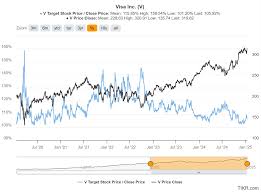

As of October 2023, Visa’s stock (NYSE: V) has seen notable activity. The company’s stock price recently hit an all-time high of $256 per share, reflecting a year-to-date increase of approximately 18%. Analysts attribute this growth to robust quarterly earnings, a surge in digital payments, and a strategic focus on technological advancements, such as contactless payment solutions.

According to Visa’s latest earnings report, quarterly revenues increased by 16% year-over-year, with a net income of $3.5 billion. This financial success can be largely credited to the growing adoption of e-commerce and the shift in consumer behavior due to the pandemic. Visa’s strategic partnerships with fintech companies have also enhanced its competitive edge in the market.

Industry Trends Affecting Visa Stock

The financial landscape is evolving rapidly, driven by innovations like blockchain technology, cryptocurrency acceptance, and digital wallets. Visa has made significant strides in incorporating these technologies into its business model. Recent initiatives include collaborations with major cryptocurrency exchanges, allowing users to transact in various digital currencies seamlessly.

Furthermore, the company’s efforts to enhance security protocols for online transactions have built consumer trust and contributed to sustained demand for its services. As digital transactions continue to rise, Visa’s ability to adapt and lead in this space is likely to bolster its stock performance.

Future Outlook

Market analysts predict that Visa’s stock will remain strong in the upcoming year, with projections for further growth driven by technological advancements and increasing consumer trust in digital payments. However, challenges such as regulatory scrutiny and competition from emerging fintech companies pose potential risks to its market dominance.

Investors should consider Visa’s historical resilience and strategic positioning within the payments sector when evaluating its stock. It is crucial to remain attentive to industry trends, regulatory changes, and Visa’s ongoing innovations in payment solutions that could significantly impact its performance.

Conclusion

Visa remains a significant player in the financial services sector, and its stock continues to attract attention due to its robust performance and strategic initiatives. As the digital payment landscape evolves, Visa’s ability to innovate and adapt will be key in maintaining its stock value. Investors looking to navigate the complexities of the market should keep an eye on Visa, as its stock could present promising opportunities in the future.