Current Insights on Dollarama Stock Performance

Introduction

Dollarama Inc. has become one of the most recognized names in the Canadian dollar store sector. With operations including over 1,300 locations across Canada and a focus on providing affordable products, the company’s stock has been under the scrutiny of many investors and analysts alike. Given the current economic climate and the ongoing shifts in consumer behavior, understanding the trajectory of Dollarama stock is essential for potential investors and market watchers.

Recent Performance

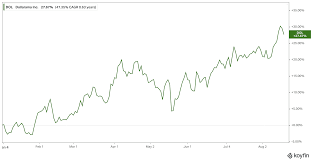

As of October 2023, Dollarama’s stock has shown resilience, with recent figures highlighting a steady increase. The stock price surged by approximately 10% over the last quarter, buoyed by strong quarterly earnings reports that exceeded analyst expectations. According to the company’s latest reports, Dollarama recorded a revenue growth of 8% year-over-year, driven by an increase in store traffic and an expansion of its product range.

Analysts attribute this growth to various strategic initiatives, including the introduction of new product lines aimed at diverse customer bases and an emphasis on maintaining competitive pricing. Notably, the average transaction value has also risen, indicating that consumers are willing to spend more per visit, which is a positive sign for impending profit margins.

Market Trends and Consumer Behavior

In light of rising inflation and the cost-of-living crisis, consumers are increasingly seeking out value-driven shopping options. This has positioned Dollarama favorably within the market, as more shoppers turn to discount retailers for their purchasing needs. Industry experts suggest that this trend will likely continue into the next fiscal year, potentially boosting Dollarama’s market share.

Additionally, Dollarama plans to expand its footprint with new stores set to open in underserved areas, further enhancing its customer base and accessibility. This initiative aligns with the company’s objective to target emerging market demographics, particularly younger consumers and families looking for budget-friendly options.

Significance for Investors

For investors, the current performance and future prospects of Dollarama stock suggest a potentially profitable opportunity, especially for those interested in resilient retail stocks during economic uncertainty. However, investors should remain cautious and consider broader market conditions. Monitoring inflation rates and consumer confidence will be crucial as these factors can significantly influence retail performance.

Conclusion

The outlook for Dollarama stock appears optimistic as the company adapts to changing consumer needs and market conditions. With strategic expansions and a strong grasp of affordable retail, Dollarama is well-positioned in the fiscal landscape of Canada. As always, potential investors should conduct thorough research and remain updated on market developments to make informed decisions.